15 January 2021

By portermathewsblog

via domain.com.au

A few simple tweaks can make your space feel brand new. Photo: Stocksy

A few simple tweaks can make your space feel brand new. Photo: StocksyThere’s something about the flip of a calendar page that makes us want to reinvent ourselves – and our homes. And having spent more time indoors this past year, fittingly we’ve turned our attention inwards – to transform where we live.

We asked the experts – interior designers, stylists, architects, real estate agents and more – how to make easy home upgrades to create a relaxing, connected and inviting space.

- Repaint your front door

New year, new front door. Photo: Cranberry Design

New year, new front door. Photo: Cranberry Design

“There’s nothing like arriving home to a little joy,” says Wendy Davey, principal of Cranberry Design. “Consider this year’s Pantone colours, sunshine yellow and gray.”

- Declutter

For an immediate result “unpack everything, give it a good clean and then only put back what you really love and use”, says interior designer Meredith Lee.

- Frame and hang your art

“Well-framed art is essential,” says stylist and decorator Claudia Stephenson. “It doesn’t matter if the art is thrifted or painted yourself, professional framing makes it look a million bucks.”

- Mix contemporary and vintage

Vintage and contemporary pieces work well together. Photo: Gorman

Vintage and contemporary pieces work well together. Photo: Gorman

Match a family heirloom with a store find that catches your eye, says interior designer Danielle Brustman. “Contemporary and vintage furniture talk to each other and can reflect the rich tapestry and history of our lives and the way we live.”

- Be clever with storage spaces

Whether in the roof, under the floor or integrated into larger rooms, make storage a priority, says William Blake, of Blake Studios, especially if “the house needs to grow older with younger families”.

- Refresh your paint

Painting both the interior and exterior can have a huge impact, says interior designer and decorator Jasmine McClelland. “Dulux’s website has some wonderful colour combinations, which give a visual before you take that first step. Or get a colour consultant out to give you even more confidence.”

- Follow the rule of three

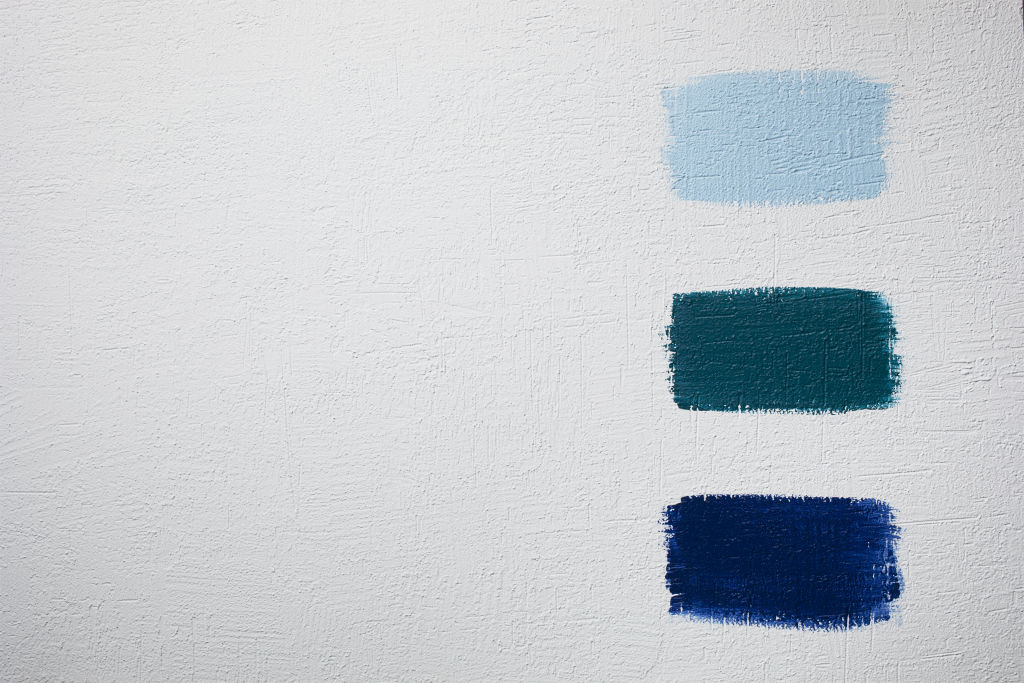

Try before you buy. Photo: Haymes Paint

Try before you buy. Photo: Haymes Paint

While on painting, “always try out at least three variations on the colour you think you want before you commit”, says Stephenson.

- Get in a fresh set of eyes

When you’ve lived in the same home for a while you stop seeing things, says Lee. “Get in a trusted friend, or design professional, and you might find some new solutions to old problems.”

- Fix the small things

Keep works manageable by regularly updating those simple things you habitually overlook, says principal at Garwoods Estate Agents, James Garwood. “Painting skirting boards and door frames, balustrades and the insides of your balcony, offer the easiest uplift.”

- Connect to the outdoors

A functional outdoor space can act as an additional room. Photo: Supplied

A functional outdoor space can act as an additional room. Photo: Supplied

“Using large doors and windows can effectively create an additional living area, especially when the sun aspect is considered,” says Blake.

- Refresh your outdoor space

Add new cushions, a striped beach umbrella and an outdoor drinks trolley, says Davey, while for winter she suggests a fire pit, “so small groups can chat and feel connected”.

- Invest in the best home accessories you can afford

“Gorgeous velvet pillows filled with duck down will last forever, while a Dinosaur Designs vase or bowl for the coffee table will add texture and pattern,” says Stephenson.

- Add some bathroom curves

They create a welcoming and nurturing effect, says Brustman. “Adding a few curved lines to your design will soften a bathroom in the subtlest of ways.”

- Landscape your garden, rooftop or balcony

Figure out how you want your outdoor space to work for you. Photo: Cranberry Design

Figure out how you want your outdoor space to work for you. Photo: Cranberry Design

Hire a professional for a purpose-built design, says McClelland. Ask yourself: Do I want an outdoor kitchen/living space? Multiple sitting spaces for entertaining? A sanctuary to retreat to? “Get the landscape team to turn it into a reality, or with some hard labour, make it happen yourself,” she says.

- Think about lighting

Fix outdated fixtures, bulbs and switches, says Garwood. “Installing a dimmer can also create ambience especially for entertaining.”

- Re-do your bedroom

Create that holiday/hotel feeling at home with “a gorgeous new feature bedhead and bedlinen”, says Davey.

- Make colour updates

Update your accessories to stay on trend, advises Meredith Lee. Photo: Elizabeth Schiavello

Update your accessories to stay on trend, advises Meredith Lee. Photo: Elizabeth Schiavello

“Interior colours are like clothes, they regularly change, and rooms date when trends move on,” says Lee, who recommends smaller accessory switches for a fresh look.

- Add a ceiling fan

“A great way to cool the house and increase ventilation, that’s far more cost-effective than air-conditioning”, says Garwood.

- Update textiles

Updating your bedding is an easy way to give the room a refresh. Photo: Supplied.

Updating your bedding is an easy way to give the room a refresh. Photo: Supplied.

Think throws, rugs, cushion covers, bedding, towels and more, says McClelland. “It never disappoints and gives a home a new energising lease on life.”

- Add colour to your timber joinery

Stain your timber with slightly muddy tones says Brustman, adding “character and mood to help create a warming and elegant atmosphere.”

- Install skylights around entries, stairs and voids

These areas can benefit from natural light throughout the day, says Blake. “Just refrain from using them in bedrooms and retreat spaces.”

Comments (0)

04 September 2020

By portermathewsblog

via homebeautiful.com.au

We ask a cleaning expert to share her secrets for a thoughtful and thorough clean – by Rosanne Peach

Shania Shegedyn

Shania ShegedynThe time is nigh to dust off the winter layers in your home and prepare to throw open the doors for entertaining and enjoying the warmer months. We ask Angie Kelso from Platinum Housekeeping in Sydney how it’s done.Sue Stubbs

1. Spray the cloth, not the surface, so you don’t have to spend time wiping off any excess.

2. Work the room and you won’t miss anything. Start at the door and move clockwise around the room, cleaning everything on and against the wall, then clean furniture in the middle of the room.

4. Put a little essential oil on the light globe in a lamp. When it warms up, the scent will spread through the room.

5. Use a lint remover to remove dust on your lampshades and curtains.

6. Vacuum everything – the inside of the fridge, the oven, the toaster and the cutlery drawer.

7. A hair dryer can remove dust from a computer keyboard, the bottom of a handbag and the corner of a cupboard.

When you finish cleaning a room, close the door. Then, when you’ve finished cleaning every room, go back and inspect each one, leaving the door open when you’re happy with the result.

Armelle Habib

Armelle Habib

Comments (0)

24 August 2020

By portermathewsblog

via reiwa.com.au

The Perth rental market’s vacancy rate has dropped to 1.6 per cent, which is the lowest it has been since March 2008.

REIWA President Damian Collins said a vacancy rate around three per cent is generally considered to create a good balance between supply and demand.

“The vacancy rate has remained below three per cent for 21 consecutive months, which has ensured rents generally started to stabilise after the post mining boom downturn,” Mr Collins said.

“However, with it now sitting below two per cent, we are starting to see the impacts of limited stock, and it is only a matter of time before rents rise. In some areas, agents are reporting rents are already on the move up.

“We are also seeing vacancy rates decline in the regions, with some areas experiencing a vacancy rate lower than Perth, such as Albany and Kalgoorlie which are now at 0.9 per cent.”

Rental stock on reiwa.com

In July, there were 3,553 properties for rent on reiwa.com, which is 50 per cent less than what was available in July 2019 and it is creating competition amongst prospective tenants.

“There are a number of factors that may have contributed to lowering the vacancy rate, such as the lack of new supply due to investors staying out of the market, expats returning back to WA, and investors selling their investment properties,” Mr Collins said.

Rental searches on reiwa.com

According to reiwa.com data, there were 726,688 searches conducted for rental properties in WA during July demonstrating rental properties are in high demand, with Scarborough the top searched suburb (16,029 searches), followed by South Perth (12,341), Mandurah (11,901), Joondalup (11,792) and Subiaco (11,609).

Impacts of COVID-19

With the review of the Residential Tenancies (COVID-19 Response) Act 2020 coming up, it’s vital that the government remove all restrictions and limitations for non COVID-19 affected tenants.

“Investors are concerned about returning to the market due to the limitations on their ability to put rents to market and evict tenants who do not pay their rent. While we’d prefer to see the legislation lapse in its entirety, if there is an extension, it must be for the very small number of tenants still affected,” Mr Collins said.

“If we don’t encourage investors back into the market, then the rental shortage will only get worse.”

If you are looking for a rental property click the below link.

https://pmmetro.com.au/for-rent

Comments (0)

29 July 2020

By portermathewsblog

23 July 2020

from reiwa.com.au

With the recent building grants announced by the State and Federal Government, you might be feeling inspired to build your dream home instead of buying an established property.

If you are one of those people who took the plunge and bought a block of land, or maybe your bathroom just needs a facelift, then it’s time to start thinking about what the perfect bathroom means for you.

We spoke with senior building designer for Summit Renovations, Ashley Tunley about the bathroom design trends that have gained momentum in 2020.

“Bathrooms remain one of the most popular rooms in an Australian home to renovate. We spend so much time in them, so it’s important to make sure the design and layout works for everyone in the family,” Mr Tunley said.

Top emerging bathroom trends

Pop of colour

Don’t be afraid to inject a little colour and fun into your bathroom.

The perfect addition to a neutral bathroom is an unexpected pop of colour which will create a focal point, either with your tiles, basins or hardware – the choice is yours!

Tapware

Brushed tapware seems to be increasing popular. Wall mixers and wall mounted tapware in this finish really stands out against the splashback.

One trend we’re seeing no signs of slowing down is the use of black tapware, which continues to gain momentum when it comes to bathroom renovations.

Freestanding baths

Freestanding baths instantly turn your bathroom into a resort-style sanctuary and are very popular amongst those renovating when adequate space is available.

With many different styles and sizes from oval or rectangle to D-shape and round, there’s plenty of options to choose from.

.jpg) A bathroom built by Summit Renovations

A bathroom built by Summit Renovations

Walk-in showers

A walk-in shower provides a contemporary finish and with no door or minimal glass – it really is a showstopper when it comes to a bathroom renovation.

Not only is a walk-in shower safer for children and the elderly, it’s also much easier to clean. With fewer nooks and crannies, that means less dirt and mould that can accumulate.

It also allows for a shower with a floor-to-ceiling design which gives you more options for where you place the shower heads and tapware.

A walk-in-shower by Summit Renovations

A walk-in-shower by Summit Renovations

What about materials and textures?

Use quality, natural materials for surfaces such as stone benchtops which remain a popular choice in the bathroom due its durability.

Textured wall tiles are a popular choice as not only do they add personality and life to a bathroom, but they also prevent condensation forming on your walls.

When it comes to your bathroom vanity, a great way to add texture and warmth is by adding feature timber laminate. This continues to be a popular material due to its variation in colours and tones and it offers a timeless look.

According to Mr Tunley, there is no such thing as a one-size-fits-all bathroom solution.

“If the design of your bathroom is carefully considered, there’s nothing stopping you from having the bathroom of your dreams,” he said.

Before you breathe life into your new bathroom, make sure you’ve read our ten tips for renovating your bathroom.

Comments (0)

05 February 2020

By portermathewsblog

via domain.com.au

Get ahead of the curve by dipping your brush into 2020’s most coveted colours Photo: Annie Sloan

Get ahead of the curve by dipping your brush into 2020’s most coveted colours Photo: Annie Sloan

Looking to update your home? Fresh colour is an easy DIY and affordable way to up-style any home.

Get ahead of the curve by dipping your brush into the most coveted colours and steal these insider tips for the perfect painterly refresh, inside and out.

Lilac, pale pink and mint

Why: “With neutral colour schemes dominating the last few years, it’s time for some soft, subtle hues,” says designer Justine Brown from Chocolate Brown. “They complement neutrals and tie back with on-trend pale timbers, terrazzos and marbles beautifully.”

Where: A wash of mauve, rose, blush or mint adds colour and whimsy, and lives easily in any space as a neutral or pretty backdrop. “Introduce via your bed linen and soft furnishings,” says Brown. “Combine with tarnished brass or try a mint green laminate with pale timber and white cabinetry in the kitchen.”

We love: British Paints Lilac Lies, Dulux Mint Twist, Chalk Paint in Paloma.

Expert Tip: “These colours work harmoniously together,” says colour and paint expert Annie Sloan. “Add a stronger hue to prevent them looking too sweet, or white for contrast. For boldness, introduce yellow, black and white, or incorporate pastel floral fabrics for an English Countryside look.”

‘I love dirty mustard tones with pale timbers and concrete.’ Photo: Robert Walsh

Vibrant yellow and mustard

Why: “Yellow is so uplifting,” says Brown. “I love dirty mustard tones with pale timbers and concrete.”

Where: Yellow works anywhere and suits all furniture, artwork, and decor. It even works in kids’ bedrooms for a space they won’t outgrow. “It’s fabulous with tarnished brass bathroom fittings,” says Brown. “Or layer with blues, pinks and whites in the bedroom.”

We love: Dulux Dandelion Yellow, British Paints Yellow Mania, Porters Paints Amber.

Expert tip: “Mustard takes neutrals one step further in terms of depth,” says Brown. “It’s the perfect addition if your palette is looking bland.”

When the correct tones are applied, this is a palette that can be applied inside and out with ease. Photo: Felix Forest

Greige

Why: With grey on the wane, the combination of grey and beige provides fresh sophistication. “Greige evokes calm and stillness,” says designer Madeleine Blanchfield. “It’s subtle but gives the impression a space has been thoughtfully decorated. It’s warm without being overwhelming.”

Where: Greige looks beautiful with classic white trims or applied from top-to-bottom for real luxury. “It’s the perfect neutral and foil to add colour to,” says Sloan. “It works in most rooms and looks brilliant with reds, pinks and greens. It sits elegantly in the background, allowing colours to pop out from it.”

We love: Porters Paint in Grey Pepper, Chalk Paint in Country Grey

Expert Tip: “Taking photos of the beach and gardens allows us to pick colours within the greige spectrum,” says Blanchfield. “We use these natural tones to find a closer match in different paint ranges.”

A wash of mauve, rose, blush or mint adds colour and whimsy. Photo: Robert Walsh

Earthy tones

Why: Rich and moody, this palette provide an effortless connection between interiors and outdoors.

“Orange, red, tan and brown feel grounding,” says designer Nickolas Gurtler. “They feel good to live with because they are characteristic of nature which is always constant in our lives,”

Where: When the correct tones are applied, this is a palette that can be applied inside and out with ease.

“For opulence, choose dark unsaturated tones,” Gurtler says. “You can manipulate these colours to do almost anything.”

Expert Tip: Choose different shades and fine-tune the mood of your room. “Select one hue and use its multiple tones in different textures,” says Gurtler. “Be sparing or go bold. Both work.”

We love: Taubmans Barrel O Rum, Delta Clay

From grassy shades to desert hues, green delivers impact whilst feeling soothing to live with. Photo: Felix Forest

Back to nature green

From grassy shades to desert hues, green delivers impact while feeling soothing to live with.

Why: “Green is soothing and honest, or opulent and luxurious,” says Gurtler. “It depends on how it is used.”

Where: Apply everywhere, from walls and doors to pots and cabinetry. “I like green in the bedroom, bathroom and living spaces,” he says.

Expert Tip: High-gloss finishes provide luxury and impart a soft glow by bouncing light around a space.

“Combine deep hues with black, white and brass for opulence,” suggests Gurtler. “Unsaturated greens, like eucalyptus, pair well with greys, whites and blonde timbers.”

We love: Porters Paints Cosmos and Nori, Dulux Dinosaur

Comments (0)

13 January 2020

By portermathewsblog

via domain.com.au

The summer break is a perfect time to tackle those neglected DIY tasks. Photo: iStock

There’s no time like the summer break to get around to all those tasks you’ve been meaning to do. Without the busyness of work and general life, focusing on some of those neglected areas of the home means you’ll start the year fresh, updated and accomplished.

It’s key to decide which home DIY projects you’ll invest your time and money into. Are there any that have really been on your mind? What will add value to your home?

Between beach trips and pool-side relaxation, here are some ideas for home DIY that are easy enough to complete over your summer break and won’t break the bank.

Freshen up your interior painting

Anyone can work some magic with the right colours and a paintbrush. With warm weather on the agenda, your coats will dry fairly fast, making it an easy summer fix.

If you’ve got wallpaper to remove, holes or dints to patch, make sure you do that before you start on the painting.

Typically, prep and painting take anywhere from three to six hours per room, depending on the size and direction to the sun.

It doesn’t take long to give the walls a fresh coat. Photo: iStock

Planting and landscaping

Who doesn’t enjoy a sunny afternoon in the garden or stroll through the nursery choosing new flowers? Your garden refresh could be as simple as replacing furniture or as complex as constructing an entertainment area.

For the budget-conscious, planting cuttings from friends and family is a great way to get your garden started and add in some new species.

While it can be difficult to estimate the time frame of a landscaping job, small jobs such as replacing furniture or planting could all be knocked over in a day. For larger tasks such as laying pavers or grass, allow a few days.

Who doesn’t love an afternoon in the garden? Photo: iStock

Who doesn’t love an afternoon in the garden? Photo: iStock

Re-tiling kitchen splashback

Make sure to weigh up your experience here. Nobody wants to end up with an uneven, less than perfect splashback in their kitchen.

Another thing to pay attention to is the type of tiles you are going to use before you dive straight in. Some tiles are harder to both lay and align.

If you’re unsure but keen to give it a go yourself, YouTube is a great place to gather info, get tips and watch how the professionals do it.

Before you start, make sure you consider the knock-on effect, so it doesn’t turn into a mountain of a job. For example, if your tiles sit behind your benchtops, it will become a much more complicated task. If the colour is quite polarising, will it mean eventually replacing all the tiles throughout the home?

Curtains are an easy way to transform a room. Photo: Stocksy

Curtains are an easy way to transform a room. Photo: Stocksy

Updating the blinds

Blinds have the power to transform the whole room, adding colour, light or texture with minimal effort or costs involved. If you’ve already got tracks in place, then it’s just a case of replacing the curtains, which can be done in half a day.

When it comes to choosing your curtains and the hooks, make sure to seek advice from staff in-store. The different styles of hooks can be confusing, but with the right advice, you’ll be set for an easy DIY task.

Lighting changes

Just like curtains, lighting also has the power to change a room entirely. Lighting can be a statement piece, add ambience and is an economical way of sprucing up the home. Be sure to call on a licensed electrician for any installation that needs to be done.

Comments (0)

13 November 2019

By portermathewsblog

via reiwa.com.au

Residential master bedroom designed by Meli Studio

Downsizing is a part of life, as well as part of your property journey. But, just because you are moving into a smaller space, doesn’t mean you have to downgrade on the visual appeal.

We spoke with interior design expert, Julie Ockerby of Meli Studio who specialises in sophisticated living for seniors nationwide, who said downsizing is the perfect opportunity to design your ‘forever home’ exactly the way you want it.

Here are Julie’s 10 tips to help you downsize in style, while making the most out of your smaller space.

1. Only keep the things you love

Downsizing gives the perfect opportunity to give away or even sell anything in your life that doesn’t make your heart sing.

It may well be that you’ll need to buy smaller furniture items anyway, so consider this as an opportunity to let go of tired old pieces and replace them with the furniture that you’ve always wanted, especially when you don’t have to worry about pleasing anyone but yourself!

2. Don’t be afraid to be bold

When picking fabrics for any new furniture, throws, bedspreads, curtains or cushions, don’t be afraid to go bold with colours and textures, as this can help bring smaller spaces to life.

To really future-proof your new abode, pick fabrics that are stain resistant and with waterproof backing.

3. Height matters

Make sure that any new furniture is at a height that suits you. Ensure your bed is not too low or too high, while sofas and armchairs should not be too low, for ease of access as you get a little older.

4. Give yourself space

To create a home you can live in for as long as possible, space is essential.

This may seem counter-intuitive when downsizing, but even though you’re probably losing two or even three bedrooms, make sure your rooms are not too small to allow good access around your bed, dining table, chairs and sofas. You’ll be especially thankful for this if you or your friends end up needing a walking stick.

Julie Ockerby holding the fabric collection of her new range

Julie Ockerby holding the fabric collection of her new range

5. Deck the walls

One area you might need to edit a bit, but don’t need to cull dramatically, is your artwork.

Create a dramatic feature wall by covering one wall with your favourite pieces, potentially combining art from several rooms in your old house.

6. Avoid clutter

Clutter is the enemy of good interior design and easy living. Cluttered tables and shelves are harder to keep clean, easier to mess up or knock over, and can actually be confusing on the eye and thus the mind.

You’ll appreciate and enjoy having just your favourite trinkets on display – even if you have to rotate them every now and again.

7. Don’t slip up

Use non-slip tiles wherever possible. Definitely use them in the bathroom, but also consider the kitchen and laundry, where spills can quickly become just as much of a hazard as a wet bathroom floor.

8. Light up your life

Good lighting, especially in often neglected areas like the shower or the dressing space in front of your wardrobes, can make a huge difference to the functionality, aesthetics and safety of essential areas that are used daily.

9. Say no to sharp corners

This applies to all ages and can give you more room to move without worrying about bumping into any nasty corners. It’s also an especially handy tip for when visiting grandchildren are toddling around.

10. Spoil yourself

Finally, splash out a with just a bit of the financial equity you hopefully free up when downsizing on an interior feature you’ve always dreamt of but could never quite afford.

Perhaps it’s a top-of-the-line steam oven, his and hers vanities or a stunning statement piece of art.

Are you looking to downsize in Perth? See what’s for sale.

Comments (0)

24 October 2019

By portermathewsblog

via domain.com.au

Jessica Bellef is the author of the book Individual. Photo: Sue Stubbs.

Do you know what your favourite colour is? Ask a kid that same question, and the answer is instant and unwavering. As adults, we may have forgotten that an allegiance to a certain shade was symbolic of so much when were young.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. We requested everything – outfits, bedroom walls, pencil cases, birthday-party decorations – in our chosen chroma. Our hero hues made us happy, even though we were likely to move on to another colour within a month’s time.

Fast-forward to our adult years, and we no longer spend time discussing our favourite colours. Sadly, our personal spaces often lack direct reference to the colours that make us joyful.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. Photo: Sue Stubbs.

Declaring a favourite colour was our way of defining ourselves and telling the world what we were about. Photo: Sue Stubbs.

The thing is, we make decisions every day that unconsciously highlight and reinforce the palettes to which we are naturally drawn. From the clothes in our wardrobe to the food we put on our plate (and heck, even the plate itself), our choices about colour continue to tell the story of who we are.

If our homes work best for us when they reflect what makes us happy, secure and comforted, then shouldn’t we try to inject our own colour palette into the space?

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Countless articles, workshops and textbooks have delved deep into the technicalities and nuances of colour, breaking the complexities down into rules and prescriptive palettes, and often not leaving room for creative interpretation.

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Photo: Sue Stubbs.

Most interior stylists and designers will tell you that working with colour is the most immediate way to change the mood of a room. Photo: Sue Stubbs.

It can be a daunting and stifled way to learn about something that is so personal. It’s no wonder that lots of adults are afraid to play with colour in their homes – they’re too scared to jump in and express themselves with paint and decor, fearing that they will get it “wrong”. When it comes to colour, however, it isn’t so black and white.

We all have primal, physiological responses to certain colours that we can’t control. High-energy reds get the heart racing, while soft blues slow us down. We also have very individual thresholds when it comes to how much colour we can take before nausea sets in.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space.

We all have primal, physiological responses to certain colours that we can’t control. Photo: Sue Stubbs.

We all have primal, physiological responses to certain colours that we can’t control. Photo: Sue Stubbs.

Our perception of a colour is tinted by our own life story and learned associations. All our memories, positive or negative, will have a connection to colour in some way: the school uniform that was begrudgingly worn, the facade of a crumbling building admired on an exotic holiday, the walls of the dentist’s waiting room.

It is these fragmented moments that form our preferred colour palettes.

We should unapologetically colour our home environments in palettes that are unique to us, in ways that mean something to us. We need to spend a little time thinking about the colours that give us joy, just as we would have done as bright-eyed young things in the school playground.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space. Photo: Sue Stubbs.

Some people love the feeling of being enveloped in a colour-saturated room, while others would prefer to spend their time in a colour-neutral space. Photo: Sue Stubbs.

Colour considerations

These are not rules, but things to think about:

Get in tune with the colours to which you react positively. Recall places and moments that made you feel good, and create a mood board (digital or physical) that represents these memories. Take note of recurring colours and themes.

Adding colour to a room doesn’t have to mean you must paint the walls in vibrant hues. Colour can be added to a neutral-walled room through artworks, textiles and decor, and you can add as much or as little as you want.

Individual by Jessica Bellef, Murdoch Books. Photo: Murdoch Books.

Individual by Jessica Bellef, Murdoch Books. Photo: Murdoch Books.

Know that you can have too much of a good thing. Overusing one colour in a space will either overwhelm you with its intensity or be so monotonous that you will find the space boring and flat. Play around with a mix of colours in a space until you find a balance that pleases you.

Understand that paint is temporary and decor is easily swapped out. There is no harm in trying new things, as “mistakes” can be erased swiftly.

Observe the scene outside your windows and the way the light works its way through the house. I love having a green quilt cover in my bedroom, as it connects the room to the treetops directly beyond the window, drawing the outside in and grounding me in nature.

Our preference for certain types of colour will evolve as we grow and advance through our life stages. Embrace these changes, and never stop experimenting with colour in your home.

Comments (0)

21 August 2019

By portermathewsblog

via domain.com.au

I’ve learnt a few lessons and gleaned good advice from colleagues. Photo: Stocksy

After almost a decade in the same house, I’d forgotten how painful it can be to move.

The sort, the pack, the kids circling around your feet – and, in our case, a stressed cat who marked his territory somewhere but smelt like everywhere – and clearing the last of the household dross before a manic clean.

We would have loved to have outsourced every aspect of the move but budget constraints came into play so we were forced to take on the task ourselves.

In a few months we have to do it again, and this time we’re going to do things differently. I’ve learnt a few lessons and have gleaned good advice from colleagues. This is what we’ve learnt:

1. Hire movers (or rope in friends with beers and pizza) early

We found many of our preferred moving companies were already booked. What’s more, you need to research their costs and reputation. Ours charged on an hourly rate, but once the big hand crossed from 10am we were pinged for the full 60 minutes’ labour.

Gather a packing kit early. This includes tape, plenty of boxes and permanent markers. Photo: Stocksy

Gather a packing kit early. This includes tape, plenty of boxes and permanent markers. Photo: Stocksy

2. Change your address details in advance

Contact insurers, the bank, the council and so on. Embrace Australia Post’s mail forwarding service, which will notify some parties like banks, energy and phone providers.

3. Assemble your packing kit

Hoard boxes in many sizes. We were lucky to have a friend who’d recently moved, but also try supermarkets and liquor stores which often have spare boxes available. Cheap but large bags, the type you find at $2 shops, are great for soft big items such as linen, pillows, clothing and rugs.

You’ll also need packing tape, a tape dispenser (no one likes hunting for the start of the roll), bubblewrap or – just as good and more environmentally friendly – old newspapers for wrapping breakable and fragile items. We sorted out our linen cupboard fairly early on and found towels, pillow cases and flannels to be great items to wrap things like wine glasses and plates. Make sure you have a few permanent markers to label boxes.

Hire movers (or rope in friends with beers and pizza) early. Photo: Jason South

Hire movers (or rope in friends with beers and pizza) early. Photo: Jason South

4. Marie Kondo the hell out of your home

Tackle packing and sorting your belongings with this room-by-room approach almost the moment the house contract is signed. Even if you pack just one box a day during this process, that will ease the pressure on moving day. This is the perfect time to donate or sell that chest of drawers, and rid yourself of excess kitchen equipment or unwanted clothing.

Start with things you don’t really need on a day-to-day basis. Books and trinkets can be packed early. And you’ll be surprised how little your kids will miss their toys.

Tackle the kitchen at the beginning. How many wine glasses, mugs, utensils and cooking gadgets do you really need? Think like a motel owner and leave the bare minimum to make your meals for the next few weeks.

Start organising and packing your home room-by-room almost the moment the house contract is signed. Photo: Stocksy

Start organising and packing your home room-by-room almost the moment the house contract is signed. Photo: Stocksy

5. Colour-code the boxes relating to your rooms

If only we had done this, it would have made things so much easier to find our iron, hair dryer and Alexa – they are still missing …

6. Remove boxes immediately

If there is space, perhaps in a secure garage or basement, start placing the packed boxes away. This clears the house, and stops the urge to break into them to hunt for something later. If this isn’t an option, pack a full room or clear a large space where boxes can be left untouched.

7. Clean as you pack

Vacuum behind the beds, and give the doors and cupboards a wipe down – this will save time and effort on moving day.

Always designate a special place for your house keys. Photo: iStock

Always designate a special place for your house keys. Photo: iStock

8. Pay someone to clean the oven

If your budget stretches to any outsourcing, let it be for this. Cleaning the oven is a crappy job at the best of times, let alone at one of the most stressful. I can think of little worse than wiping oven cleaner and scrubbing metal racks on the evening we left. Awful.

9. Eat your way out of your home

Refrain from big grocery shops in the weeks leading up to your move. Try to use whatever you’ve got on hand, which will make the move (plus the cleaning of the fridge, freezer and pantry) all that much easier.

10. Stuff, seal and shut drawers

There’s no need to empty your clothing drawers. Get as much in them as possible, then simply seal them shut and ship them off.

Boxes with lids are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. Photo: iStock

Boxes with lids are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. Photo: iStock

11. Avoid an electrical assemblage nightmare

Place electrics in their own separate box. Take a picture before disassembling these items to see how the now-jumbled cords should be plugged in when you arrive at your new abode. Clear, resealable sandwich bags are great for screws and small parts that will be needed later.

12. Pack ‘the next day’ essentials

Invest in some large clear boxes with lids. These are great for those essentials you’ll need on the first night at your new home including toiletries, breakfast for the next day and tea and coffee. It’s a good idea to include two changes of clothing for you and the family, one work outfit and the school uniforms (including shoes), bedding for your first night, some towels and details of a good takeaway joint – cooking is going to be the last thing on your mind.

13. Make a place for your keys

And be vigilant about putting them back there during the shift. My set ended up in my son’s school bag.

If you can, hire a babysitter. Photo: Stocksy

If you can, hire a babysitter. Photo: Stocksy

14. Hire a babysitter

If that’s not an option, ask friends and family to mind the kids on the day of the move. We are forever grateful to our friends who took our young children for this stressful day.

15. Leave cleaning equipment and supplies somewhere handy

You’ll need them on shifting day and at your new house – we now have two of everything.

Comments (0)

14 August 2019

By portermathewsblog

via domain.com.au

It’s tax time and that means many Australians are finding a bit of extra cash in their bank accounts. Whether you’re planning some DIY projects or using it to inject some style into your home, here are some tips for getting more bang for your buck.

While it’s no secret that investing in good quality homewares is worth it in the long run, what are some cost-effective ways to make a major style update in the home?

Lead interior designer at Porter Davis Homes Victoria Patrizia Romeo says investing in a mature indoor plant is a great way to instantly change the look of a space.

“Investing in a taller, more mature plant can be a great way to add a focal point within the space,” she says.

“Different areas of the home will provide different conditions for your plants, so make sure you research the needs of the plant you want to buy. This will ensure that your investment will, literally, grow over time.”

If you are looking at making subtle changes to your home, consider adding house plants. Photo: Porter Davis

If you are looking at making subtle changes to your home, consider adding house plants. Photo: Porter Davis

The bedroom is your sanctuary, so investing in bedding is a no-brainer. Romeo says choosing a natural colour tone is best for making the most of your money.

“Natural fabrics such as linen, bamboo and silk are great to use, they’re durable,” she says. “Pairing these with feature cushions and chunkier statement throws is a great way to add layers within the room.”

Garden expert Bonnie Grants says now is a good time to get out in the garden and prepare for spring, and you can’t go wrong spending your tax dollars “exploring what your green thumb can do”.

“Planting now and prepping the soil, spending money on trees, grass and fertilisers is the best way to set yourself up for spring,” she says. “There’s nothing you can do to your garden that won’t be worth the money in the long run.”

Topping up your garden shed now means you’ll be ready for spring.

Topping up your garden shed now means you’ll be ready for spring.

When it comes to what to plant, flowers with bright colours are always a winner.

“I love the Alyssum flower because it’s such a good insect attractor and it can withstand just about any climate, so you’re not risking much planting it while it’s still cold,” says Grants. “It’s also unusually small so it can be planted anywhere, even in veggie patches or in planter boxes.”

Getting the garden furniture sorted out before spring sets in minimises the risk of any surprise damages.

“At the very least take a look at your garden furniture see if anything needs replacing, and make the most of the end-of-financial-year sales,” says Grants. “It’s also the perfect time to spend a little extra on gardening tools. Plus, pruning is best done at the end of winter, so you’ll need some good gear.”

Utilise different colours and textures to create an inviting and peaceful atmosphere. Photo: Porter Davis

Utilise different colours and textures to create an inviting and peaceful atmosphere. Photo: Porter Davis

The old saying you get what you pay for applies to homewares too, so putting your tax return towards something with a higher price point than you normally would is something to consider. Romeo says a sofa is a big ticket item that shouldn’t be passed up for a cheaper alternative, but it’s also important to think about your lifestyle when choosing one.

“Leather is more durable but can be costly and a white sofa may look great, but it’s unforgiving when it comes to children’s messy fingers,” she says. “Stick to neutral tones and a sofa which suits your style and can adapt to changing trends.”

Comments (0)

19 July 2019

By portermathewsblog

via news.com.au

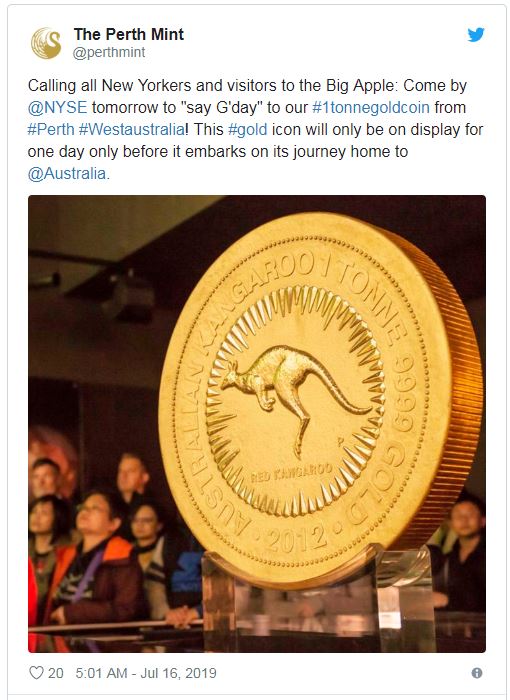

The world’s biggest, heaviest gold coin was made here in Australia but it’s been sent to the Big Apple for a day.

The world’s biggest coin was crafted in Australia. Picture: Twitter/Perth MintSource:Twitter

The world’s biggest, heaviest gold coin, which was crafted by the Perth Mint, has been delivered to the New York Stock Exchange to promote physical Australian gold being made available to US investors.

The colossal one tonne gold coin is 99.99 per cent pure gold and measures 80cm wide and 13cm deep.

It is recognised by Guinness World Records as the largest coin ever created.

It was worth $A50 million when it was cast in 2012 but its value has risen to more than $A60 million given the soaring price of the precious metal, which recently has been hitting all-time highs of more than $2,000 an ounce against the Aussie.

The coin is being displayed outside the stock exchange on Wall Street to mark the official launch of the Perth Mint Physical Gold Exchange Traded Fund, which will trade under the code AAAU from tonight.

Perth Mint chief executive Richard Hayes will ring the bell to signal the end of the trading day.

“Every AAAU share is backed by physical gold stored in our central bank-grade vaulting facilities in Perth, so at any time investors may choose to exchange part or their entire holdings for a delivery of physical gold to their door,” he said.

Its inscription reads: AUSTRALIAN KANGAROO 1 TONNE 9999 GOLD and the year-date 2012.

The other side of the coin portrays the Ian Rank-Broadley effigy of Queen Elizabeth II and the monetary denomination of one million dollars.

“The colossal coin is a magnificent Australian icon symbolising one of the Mint’s most extraordinary accomplishments since it was established in 1899,” the Mint’s website states.

The coin was issued as legal tender under the Australian Currency Act 1965.

Prior to the coin’s visit to the NYSE, it made an exclusive trip across Europe and Asia in 2014 and has mostly been housed at the Mint’s Gold Exhibition.

Comments (0)

09 July 2019

By portermathewsblog

via domain.com.au

The homes of the future will be reliant on voice-activated technology, making your ordinary remote control obsolete. Photo: Stocksy

The homes of the future will be reliant on voice-activated technology, making your ordinary remote control obsolete. Photo: Stocksy

What will our homes look like in the future? It’s tempting to daydream about robots and self-driving cars, but the next 10 to 20 years will probably look much the same as they do now, with a few more conveniences.

Walkley Award-winning author and broadcaster Antony Funnell, who hosts the ABC podcast Future Tense, predicts that the electricity grid as we know it will shrink, while our reliance on renewable energies will undoubtedly grow. Meanwhile, many of the things we currently consider niche will soon be used by every household.

Here are the biggest predictions from Funnell for home life in 2030 and beyond.

Say goodbye to light switches

The homes of the future will be reliant on voice-activated technology, making your ordinary remote control obsolete. Your entertainment systems, airconditioning and light switches will be able to turn themselves on and off at the sound of your voice. Love them or hate them but Siri and her pal Alexa will only grow in use.

Love them or hate them but Siri and her pal Alexa will only grow in use. Photo: Stocksy

Love them or hate them but Siri and her pal Alexa will only grow in use. Photo: Stocksy

And … your television

“The days of everyone in the family sitting around a television screen are disappearing,” says Funnell. But that’s not because we’re giving up on our entertainment. Tablets, iPhones and laptops will be how we view our shows, putting an end to communal watching – at least within the home.

“The idea that they’ll be a big television screen in the middle of the room with the family focused on it, those days are over,” says Funnell.

Which will have a knock-on effect on design. “With the central TV disappearing, you’re going to see a trend toward more ‘breakout’ spaces for people, places, or nooks, where, if you want to watch the last episode of Game of Thrones, you can go away with your laptop in a room that isn’t necessarily your bedroom, but it’s not the lounge room either.”

Say hello to smart toilets

Funnell believes that toilets in the next 20 years will do more than function as a place to look at your phone. Toilets of the future will be able to weigh you, measure your vitals, such as blood sugar and blood pressure and provide feedback on what you’ve been eating. Yes, that’s right – future toilets will be able to examine your waste.

With the central TV disappearing, you’re going to see a trend toward more ‘breakout’ spaces for people. Photo: Stocksy

With the central TV disappearing, you’re going to see a trend toward more ‘breakout’ spaces for people. Photo: Stocksy

Layout

We’re already experiencing it now, but the next 10 years will see a big move toward open-plan design. No more separate rooms, instead you can expect your cooking area to flow out into your eating area and on into your backyard. And, with more technology allowing people to work from home, that backyard is going to become your new office.

“The need for a study or home office came out of a need for fixed technology – fixed phone, fixed fax, fixed computer. But with the mobility of phones and tablets, the need for a home office is gone,” says Funnell, who adds that people will now sit in their backyards or living rooms to do work.

Bigger houses

The idea that were all going to be living in tiny flat-pack houses is incorrect, says Funnell. “Researchers have found that there aren’t that many, despite the hype, and that people use them as a stepping stone to get into the housing market. They’re not really motivated by environmental issues either.”

Instead, Funnell predicts that the backlash to high-density apartment living in the inner city will lead to an exodus.

“We’re used to the narrative that the way our urban cities work is that everyone wants to live in the city centres. But it wasn’t that way after World War II,” says Funnell.

“After World War II, everyone was moving out and we had the growth of all suburbs. It’s not unreasonable to think that in the next 10 or 20 years we will have a premium put on suburbs again – liveable suburbs where people feel they can spread out a bit, where there’s bushland.”

The next 10 to 20 years will probably look much the same as they do now, with a few more conveniences. Photo: iStock

The next 10 to 20 years will probably look much the same as they do now, with a few more conveniences. Photo: iStock

Part of this backlash will be people who are sick of cramped spaces and looking in on their neighbours, and part of it will be about more people working from home.

But, cautions Funnell, it will only really be an option for those who have the money to do so, as the current housing market will lock ordinary people out of the trend.

”The move out of the inner city will only be for those who can afford to make the change. And that will just exacerbate inequality. For those at the bottom of the socio-economic scale, the future will be densely packed inner-city unit towers, because they have no choice.”

The one silver lining is that these big houses will likely be built with sustainability in mind. Funnell predicts that plastics, in particular, will be re-purposed into building materials.

But the idea that we will have fully functioning, environmentally friendly homes and self-driving cars in the next decade is a tad ambitious.

“Much of what we have in our houses now has been around since the last century, just with added modifications. Human nature doesn’t change all that much.”

Comments (0)

30 May 2019

By portermathewsblog

via finance.nine.com.au

Australia’s housing market downturn is coming to an end, with leading economists predicting a spike in house prices as soon as July.

Property prices fell one per cent nationally in January, with CoreLogic data showing a smaller decline of 0.5 per cent in April – a result tipped to be repeated for May.

It comes after Commonwealth Bank’s incoming, home loan applications jumped to a 10-month high and strong predictions of interest rates cuts.

Expect to see a whole lot more of these in the coming months. (AAP)

Expect to see a whole lot more of these in the coming months. (AAP)

“Australia’s house price growth reached its worst on an annualised basis in January. Prices have continued to fall since then, but the rate of decline has slowed,” the bank wrote in a statement.

“If you look at prior cycles, an increase in house prices occurred five to seven months after the trough in the annualised growth rate. Using the average of six months, prices could rise by July.”

The bank said in every Australian house price cycle since 1989, price growth followed within seven months after the monthly annualised price decline bottomed.

Graph showing the trend repeating over the past 30 years. (Supplied)

Graph showing the trend repeating over the past 30 years. (Supplied)

Macquarie’s prediction extends further than past performance, with the bank also attributing looming interest rate cuts, relaxed lending conditions and the recent election result to its positive outlook.

“With the surprise Coalition election win, APRA’s policy change and an expected June RBA rate cut, we are more confident Australian house prices could rise within months,” the note read.

“This should flow through to better growth in housing finance and building approvals.”

AMP Capital chief economist Shane Oliver shares similar sentiments.

“The combination of the removal of the threat to property tax concessions, earlier interest rate cuts, financial help for first home buyers and APRA relaxing its 7 per cent interest rate test points to house prices bottoming earlier and higher than we have been expecting,” he said in a note.

“We now expect capital city average house prices to have a top to bottom fall of 12 per cent— of which they have already done 10 per cent — rather than 15 per cent and to bottom later this year.”

A swing in property prices has been supported with the Commonwealth Bank saying last week it saw the highest level of home loan applications in ten months.

This also coincides with CoreLogic data from the same period showing median home prices in Sydney and Melbourne increased by 0.3 per cent and 0.1 cent, respectively.

Prime Minister Scott Morrison’s victory has helped the market, economists say. (AAP)

Prime Minister Scott Morrison’s victory has helped the market, economists say. (AAP)

Nine finance editor Ross Greenwood said the threat of changes to the tax treatment on Australian housing created a lot of uncertainty in the market, but since Scott Morrison’s victory this has shifted to a “sense of immediate euphoria”.

“It is actually good news if people kind of feel OK about things,” he told Today.

“But the one thing about this is it now comes back to the old-fashioned leaders of the economy – what the Reserve Bank does, whether we get tax cuts.

“These are the things that put cold hard cash in people’s pockets. At the end of the day, that’s the thing that counts.”

Greenwood added tax cuts would have a bigger impact long-term on household budgets and finances than a decline in interest rates.

“The problem is because one-third of families have a mortgage, whereas two-thirds of families are trying to save for a mortgage to own their home and they have savings in the bank,” he said.

Comments (0)

22 November 2018

By portermathewsblog

Great news for the Western Australian economy, read the article below.

If we can be of help or offer advice on selling & leasing give us a call on 9475 9622!

By Josh Zimmerman Via: https://www.perthnow.com.au/business/housing-market/house-price-rise-on-cards-as-economy-confidence-improving-says-wa-premier-mark-mcgowan-ng-b881023908z

PREMIER Mark McGowan has this message for West Australians: buy a house now because the good times are coming back.

Exactly one year after The Sunday Times heralded early signs of life for WA’s stagnant economy, the results are in — and they are conclusive.

Data released on Friday showed the State’s domestic economy expanded 1.1 per cent in 2017-18, a remarkable turnaround after plummeting 7.1 per cent in 2016-17 and four consecutive years of decline.

This week another big step was taken towards WA reclaiming its AAA credit rating when Federal Parliament enshrined in law the hard-fought $4.7 billion GST reform package, which The Sunday Times has campaigned for since 2014.

Nearly every month this year has brought news of renewed activity in the mining sector. Rio Tinto, Fortescue Metals Group and BHP have all announced new workforce-hungry iron ore projects and the State now boasts seven lithium mines, with a second $1 billion lithium processing plant on the way near Bunbury.

Mr McGowan said he had not felt more confident about WA’s economic prospects since sweeping to power early last year.

“Every day you are seeing good signs,” he said. “The confidence is back in WA. You can feel it, you can see it and certainly it is an improvement on where it was.”

Mr McGowan tipped a turnaround in the long-declining property market and a jolt to stagnant wages would follow hot on the heels of renewed business investment.

Andrew Worland, the CEO of Rosslyn Hill Mining, and WA Premier Mark McGowan.Picture: Richard Hatherly

Andrew Worland, the CEO of Rosslyn Hill Mining, and WA Premier Mark McGowan.Picture: Richard Hatherly

“It is actually a good time to buy (a house),” he said.

“I would encourage people. Prices are low yet economic activity is picking up and so that will inevitably be followed by (demand for) housing.”

The Sunday Times joined Mr McGowan in Wiluna on Thursday to visit the oft-maligned Paroo Station lead mine, where a $US150 million investment in world-first processing technology is set to bring the operation back to viability while eliminating environmental issues previously associated with transporting lead concentrate.

The Rosslyn Hill Mining venture has just received environmental approvals to expand and build an advanced hydrometallurgical facility, which will convert lead concentrate to bars without the traditional smelting process.

Lead is among the suite of minerals abundant in WA that Mr McGowan hopes will catapult the State into global leadership in the renewable energy sector.

To that end, his Government has set aside $5.5 million for a future battery research centre, but recognises that WA-made batteries are a long way off. “That would be a longer-term initiative,” Mr McGowan said.

Comments (0)

15 October 2018

By portermathewsblog

via reiwa.com.au

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

REIWA President Damian Collins said there was excellent opportunity for buyers and investors to take advantage of current market conditions to secure their next home or investment property.

“While the worst of the market downturn appears to be behind us, the results of the September 2018 quarter reveal conditions are favourable for buyers and investors,” Mr Collins said.

Median house and unit price

reiwa.com data shows Perth’s median house price should settle at $505,000 for the September 2018 quarter.

“This is 1.9 per cent lower than the June 2018 quarter median and one per cent lower than last year’s September quarter,” Mr Collins said.

“While quarterly median figures can be more subject to stock composition changes, the fact that the annual change is only one per cent lower suggests that we are at or near the bottom.

“It was a similar story for the unit market, with the median expected to settle at $395,000, which is 1.3 per cent lower than the June 2018 quarter and 2.5 per cent lower than the September 2017 quarter.”

While the overall market experienced a decline in median house price during the quarter, 57 suburbs across the area bucked this trend.

“The top performing suburbs for median house price growth were Swan View, East Cannington, Como, Hillarys and Cottesloe.” Mr Collins said.

“In the unit market, Maylands, Midland, Tuart Hill, Fremantle and Claremont were the suburbs with the strongest price growth.”

Sales activity

There were fewer sales in the September 2018 quarter than there were during the June 2018 quarter.

Mr Collins said reiwa.com data showed 6,428 sales for the quarter, which was 4.9 per cent lower than last quarter.

“It’s not uncommon to experience a decline in sales during the September quarter, with West Australians typically less inclined to search for property during winter. We tend to see activity slow during the winter months before increasing again as the weather warms up,” Mr Collins said.

The share of house sales in Perth has increased, with reiwa.com data showing houses now comprise 74 per cent of all sales, compared to 65 per cent at the same time last year.

Perth’s top selling suburbs for house sales during the September 2018 quarter were Baldivis, Canning Vale, Morley, Dianella and Gosnells, while the suburbs to record the biggest improvement in house sales activity were Cooloongup, The Vines, Alexander Heights, Mirrabooka and Wattle Grove.

“It’s a good time to buy, which is reflected in the fact a higher proportion of houses are now being sold. This shift in the composition of sales (houses, units and land) indicates buyers are more inclined to purchase a house than they might have otherwise been. This can be attributed to housing affordability improving across the metro area, which has made buying a house a more attainable property purchase,” Mr Collins said.

“We’ve also seen an increase in activity between the $350,000 and $500,000 price range during the September quarter, which is pleasing as it indicates first home buyers remain an active component of the Perth market.”

Listings for sale

There were 13,850 properties for sale in Perth at the end of the September 2018 quarter.

Mr Collins said stock levels across the metro area had declined 3.7 per cent during the quarter.

“It’s pleasing that, although there were fewer sales this quarter, listing stock continues to be absorbed.

“This is the third consecutive quarter we’ve seen listings for sale decline, which is a positive step forward in the market’s recovery,” Mr Collins said.

Comments (0)

08 October 2018

By portermathewsblog

via therealestateconversation.com.au

Almost one in five Aussies are missing out on bargains because they are scared off by auctions.

Source: Real estate insiders

Buyers are throwing great property bargains onto the scrapheap before they have even seen them because they’re scared off by auctions, experts say.

Universal Buyers Agent property expert Darren Piper said buyers are missing out on bargains of up to 25 per cent because they are frightened off by auction sales.

“It can be daunting if you don’t know what you’re doing,” Mr Piper said.

“With television shows turning up the theatre and adrenaline of an auction it can cause buyers quite a lot of anxiety.

“But for those who aren’t put off it can be a great way to get in the door and find a real bargain.”

A recent survey by finder.com.au found one in five Aussies are “terrified” of auctions with many buyers passing over listings with an auction process.

Although the process can be intimidating Mr Piper said professional buyers agents can help to do the heavy lifting for buyers by attending auctions, making bids and finding properties worth inspecting.

“The first reaction many people have when they see a listing set as an auction is to give it a miss.

“We cut through the smoke and mirrors and ask the hard questions to determine if the auction if worth pursuing and just what kind of bargain you could get.

Mr Piper said a client had discounted a listing at 27 Cowper Street, Bulimba believing the auction listing was likely out of their price range.

But after enquiring with the estate agent and working out the value the client was able to secure the property at auction for $50k less than their max price range.

Mr Piper said it is also worth finding out how many bidders are expected to manage expectations and avoid falling into a price war.

“Most buyers turn to water at the thought of standing in a public place staring down other buyers and engaging with a boisterous auctioneer.

“We make the process less scary so buyers have the choice of handing over bidding to an expert and ensuring they get the best deal possible.

“There’s nothing worse than being out bid after you’ve spent time and money on a property, but with the right help you can snap up a real bargain.”

Comments (0)

01 October 2018

By portermathewsblog

via reiwa.com.au

Author: REIWA President Hayden Groves

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

Real estate transactions are complex. For many West Australians, it can be a challenge to determine their individual rights and responsibilities when it comes to dealing with property issues.

REIWA launched a public information service in 1992 to assist buyers, sellers, tenants and landlords navigate their property journeys. This valuable service allows members of the WA public dealing with a REIWA agent to find answers to their real estate queries and concerns.

Last financial year more than 20,000 phone calls were placed to the REIWA Information Service (2,000 more than the previous financial year), with West Australians seeking clarification and assistance from the Institute on a wide range of real estate matters.

As the WA market has slowed these past few years, the REIWA Information Service has seen call volumes increase. Residential property management continues to be the most common topic the public ring about, with 70 per cent of all phone calls for the year to date received from tenants and landlords. The remaining 30 per cent of calls have generally related to residential sales.

When it comes to WA tenants, they most commonly call REIWA to discuss the early termination of their rental lease. They also want to know what rights their landlords have to enter their property while tenanted and what rights they have with regards to repairs and maintenance.

Landlords, on the other hand, most commonly call to seek information on a tenant’s obligation to pay rent, to find out how the court system works in order to claim damages and to clarify their rights around abandoned goods.

In the residential sales market, buyers who call the REIWA Information Service generally do so to get information about their obligation to obtain finance approval within a period of time. They also commonly call to clarify their rights for the pre-settlement inspection. While WA sellers most frequently ring to find out about the settlement process, satisfying contractual conditions and to discuss buyer requests which are not addressed in the contract for sale.

The REIWA Information Service team is comprised of two full time staff members and 70 local REIWA agents who give three hours of their time every few months on a voluntary basis.

When you call up, you are given direct access to these local property experts who can educate you on areas you’re unsure about and help resolve any tricky property matters you might be facing.

If you are dealing with a REIWA agent and have a real estate query you want answered, I’d highly recommend contacting the REIWA Information Service on 9380 8200 for assistance.

Comments (0)

25 September 2018

By portermathewsblog

therealestateconversation.com.au

Over the past six months, grey clouds have been building in the distance for borrowers, and for many, the brewing storm is yet to hit in full force.

Australia’s current lending landscape is a tough one. Moves by legislators and regulators to kerb borrower enthusiasm have created headaches for those now looking to build a

portfolio.

That said, there is opportunity ahead for those able to weather the challenge.

The state of play

The runaway nature of Australian property prices in Sydney and Melbourne from 2012 was causing concern for legislators.

It was claimed investors were taking up all the stock and isolating first homebuyers from the market – and there were no indications things were going to slow down.

In 2014 the Australian Prudential Regulation Authority (APRA) responded by instructing banks to cap growth in investor lending to 10 per cent of their total loan book.

An additional move in 2017 by APRA required banks to keep interest-only loans to less than 30 per cent of their mortgage portfolio too.

While both these measures were said to be temporary – in fact, the first has been recently relaxed – they appear to have done their job too well with investor-loan growth now at single-digit percentages.

Add to the mix the current banking enquiry. It’s findings so far have levelled criticism at bank practices.

To compensate and prepare for the eventual recommendations, lenders are already tightening their requirements from borrowers – particularly investors.

What’s happened

The upshot is that getting a property loan approval at the moment is tough.

It’s been a fast turnaround too. Whereas six months ago a bank customer might have been approved to borrow $800,000, nowadays that same client might be lucky to get $500,000.

That means many who contract to purchase based on a pre-approval gained under the old guidelines, will find their application knocked back under the bank’s new rules.

Another reason for impending mortgage stress is many loans are about to roll over from Interest-only to Principal-and-Interest in the next 12 months.

This means higher repayments for some already stressed borrowers.

These customers will have little choice but to accept the new loan terms being offered by their current lender, because competition for interest only lending will be virtually non-existent.

Here’s the perfect storm scenario:

- The cost of money will go up,

- The availability of money will drop,

- And, in certain markets, value growth will be non-existent for a number of years.

Is there opportunity?

In short – yes, but it’ll be those who got their affairs in order early who’ll benefit most.

Investors who’ve built a resilient portfolio are certain to take advantage.

Your investment strategies must be long-term so you can smooth out the peaks and troughs of market and finance cycles in order to secure your future for decades to come.

1. Have impeccable records

Now more than ever, it’s important to have kept your financial records in tip-top order.

By this, I mean you need to know your numbers inside and out, and back to front.

It all has to be documented as well. Not so long ago, for example, it was acceptable to front up to the bank with little more than your estimated living costs and gross income, and with a signed statutory declaration as back up.

Nowadays, it’s a case of being able to account for every dollar. You may have put “Annual clothing allowance – $1000” in the loan application, but today’s banking credit departments are checking your credit card statements as well.

They know your Gucci shoes and Burberry briefcase cost twice that, and they’re willing to say, “No!”

Having impeccable records means you can accurately account for every dollar.

It also demonstrates to the bank that you can stay on top of your loan commitments.

Being a good customer really can pay dividends in these trying times.

2. Maintain cash flow

Cash flow is king when it comes to loan serviceability, so if you’ve built a multi-property portfolio, make sure your income isn’t overextended.

Key to this is portfolio diversification. We always recommend maintaining a buffer as part of your investment strategy because changes in interest rates, personal circumstances and the cost of living are inevitable.

In addition, banks are now upping their ‘stress test’ on client’s finances – increasing their own interest rate and cost tolerances on your supplied numbers.

Being on top of your cash flow can be the difference between a yes or no on your next loan.

3. Equity buffer

Along with cash flow you must maintain an equity buffer as well.

Having adequate equity is essential to a lender’s requirements.

The problem that often occurs during a period of high property value growth (like recently) is some owners use their new-found equity on unproductive debt.

They might spend up big on their credit cards and then consolidate that debt into their house loan.

While they’re at it, they might get a bit extra from the bank in order to buy a new car or go on holiday.

These borrowers are not allowing for the future and have effectively re-bought their property off the bank at today’s prices because they ‘feel wealthy’.

The best opportunities are there for those who have liquidity in their equity.

I’m a big believer in making your money work for you and if your equity isn’t liquid, you can’t capitalise on opportunities when they arise.

Building a resilient portfolio in times of great growth is essential so you not only survive any eventual slowdown, but can pounce on newly revealed profitable prospects.

If you’ve failed to prepare for our new, tougher financial times, now might be the chance to catch your breath, talk to an expert strategist and plan for the cycles next turn.

After all, the state of your wallet dictates the state of your mind.

Comments (0)

17 September 2018

By portermathewsblog

via therealestateconversation.com.au

The property industry is continuing to drive the Australian economy according to the latest economic growth data.

The Australian economy grew by 0.9 per cent in seasonally adjusted terms in the June 2018 quarter National Accounts released last week, with annual growth of 3.4 per cent.

Investment in new dwellings increased 3.6 per cent for the quarter, with strong results in Victoria and South Australia.

The construction industry grew by 1.9 per cent for the quarter.

Construction within the residential property sector grew by 3.1 per cent and non-residential property sector by 1.3 per cent over the quarter.

The ABS noted that the recent pickup in new dwelling investment reflected strong approvals in early 2018 which are now flowing through to commencements.

“The property industry is helping to propel economic growth to its highest level since 2012, highlighting its importance as a driver of jobs and economic prosperity,” said Ken Morrison, Chief Executive of the Property Council.

“Our national economic well-being depends on a strong property industry, supported by smart investment in vital public infrastructure for our growing cities.”

“The benefits of growth are overwhelmingly positive, but must be locked in and supported by good planning and smart infrastructure investment to ensure all Australians reap the gains,” Mr Morrison said.

Comments (0)

10 September 2018

By portermathewsblog

via therealestateconversation.com.au

Malcolm Gunning, President of the Real Estate Institute of Australia (REIA), and Leonard Teplin, Director of Marshall White debate the potential implications the most recent leadership spill could have for the residential property market.

It feels like we’ve had more leadership spills than seasons of The Bachelor, and some industry leaders are worried that Australia’s reputation for changing Prime Ministers at the drop of a hat is having negative consequences across the property market.

Director of Marshall White, Leonard Teplin says the constant change of leadership in Australia is driving residential buyer sentiment to an all-time low, and it’s the Australian public who are left to sit back and watch the fallout, again and again.

“There are no real winners, only losers. The Australian public must once again sit and watch while the effects ripple across our economy and property market,” Mr Teplin said.

“It’s no secret that every time there is an election, market sentiment drops, people delay purchases and put off big decisions until the new leader has been decided, and election promises turn into policies.

“In real estate, this sentiment is reflected in weaker conditions as buyers cautiously await the inevitable policy changes and market overcorrections that are sure to follow suit.

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

Industry leaders are concerned about the potential implications the leadership spill could have on the property market. Image by Adz via WikiCommons

“As Scott Morrison gets set to take over as the nation’s leader, property purchasers both locally and abroad will be questioning what this change in direction will mean for them and their investments,” Mr Teplin told WILLIAMS MEDIA.

But Malcolm Gunning, President of the Real Estate Institute of Australia (REIA) doesn’t believe the leadership spill will have a drastic impact on the property market.

“I don’t think there will be any change because Scott Morrison was really the architect of the current economic policy,” Mr Gunning told WILLIAMS MEDIA.

“Tougher lending criteria introduced by the APRA, and the banking royal commission is what’s really having the biggest influence on the market at the moment.”

Jock Kreitals, CEO of the REIA agrees.

“In terms of the recent changes of Prime Ministers and Ministers, I do not see any impact on the market attributable to this. The policy of the Coalition regarding negative gearing and CGT remains unchanged.

“The PM as the previous Treasurer has reiterated the position a number of times. Further, the PM well understands the impact of changes in policy having worked in a policy role in the property sector,” Mr Kreitals told WILLIAMS MEDIA.

Real Estate Institute of New South Wales (REINSW) CEO, Tim McKibbin says the new Prime Minister should put good fiscal policy ahead of economically damaging, populist politics.

“Those advocating for removing the deductibility of expenses incurred in earning assessable income in the residential property market are damaging people’s ability to acquire a home,” Mr McKibbin told WILLIAMS MEDIA.

“This is adversely impacting the property industry – Australia’s biggest employer – and playing petty politics in the misguided belief it will promote their personal brand.”

Potential implications for foreign investment revenue

Mr Teplin believes the latest leadership spill could impact international investment revenue.