14 June 2017

By portermathewsblog

Nicola McDougall via domain.com.au

Whether you’re a homebuyer or a homeowner wanting to refinance, valuations can result in you uncomfortably sweating on that all-important final number.

But, while valuers are professionals who clearly know what they’re doing, are there any strategies to improving your valuation?

Should you highlight every single improvement when the valuer is on-site or is it best to leave them alone so they can get on with the job?

Herron Todd White national director Valuation Tony Higgs says it can be beneficial for owners to be on-site but you don’t want to be over-eager.

“Obviously we’re trying to get as much information as we can while we’re on-site and if the owner is constantly following us around and going, ‘This is the toilet. This is the laundry’, well, those sorts of things we can work out for ourselves,” he says.

“It’s those things that they’ve done recently that they want to point out to the valuer, which is great, and that’s the stuff we want to know.”

For properties that have been recently renovated, Higgs suggests owners mention the improvements at the start of the valuation process and then point them out once the valuer has moved inside the property. Photo: Jessica Shapiro

For properties that have been recently renovated, Higgs suggests owners mention the improvements at the start of the valuation process and then point them out once the valuer has moved inside the property. Photo: Jessica Shapiro

Highlighting improvements which might be not immediately visible, such as solar panels, is also a good idea, Higgs says.

For properties that have been recently renovated, Higgs suggests owners mention the improvements at the start of the valuation process and then point them out once the valuer has moved inside the property.

Higgs says being on-site during the valuation not only allows owners to provide relevant information to the valuer, it also helps them to understand the process.

Metropole Brisbane Director Shannon Davis meets valuers on-site to point out improvements as well as to provide information about comparable properties. Photo: Peter Riches

Metropole Brisbane Director Shannon Davis meets valuers on-site to point out improvements as well as to provide information about comparable properties. Photo: Peter Riches

“For the owner, it’s always beneficial for them to be on-site because they can get an understanding of what the valuer has done while they’ll out there,” Higgs says.

“If they’re there with the valuer at the time, and if there are issues that they want to raise, that’s the best time to flag them.”

Metropole Brisbane Director Shannon Davis meets valuers on-site to point out improvements as well as to provide information about comparable properties.

And he’s not afraid to challenge a valuation that’s nowhere near his own research.

“There can be some valuations that are way off. We’ve challenged valuations before, especially near the turn of the market,” he says.

“You might have someone who’s just out of the odds who brings it in $20,000 or $30,000 under, but we’re at the market coalface day in and day out.”

One such valuation, Davis says, was a valuer who missed one bedroom entirely and therefore came in about $70,000 below the expected value.

Insisting on an on-site rather than kerbside or desk-top valuation could help to reduce mistakes and also potentially improve the end result, Davis says.

“I think wherever possible, it’s worthwhile to meet the valuer at the property and show them through the scope of works and bring a list of comparables as well,” he says.

“Also (challenging a valuation) might cost a little bit more… but spending money to get access to more money can be really worth it if you’re acquiring an appreciating asset.”

Comments (0)

14 June 2017

By portermathewsblog

Jennifer Duke via domain.com.au

Housing was a hot button topic for the 2017/2018 federal budget, so it’s no surprise there were a raft of changes for real estate.

The new measures have impacted on a variety of housing rules from first-home buyers’ savings strategies to what investors can claim at tax-time.

Here are the five big announcements to know about.

More supply is just one part of the housing push with a raft of initiatives rolled out in the 2017/2018 federal budget. Photo: Pat Scala

More supply is just one part of the housing push with a raft of initiatives rolled out in the 2017/2018 federal budget. Photo: Pat Scala

1) Foreigners can only buy up to 50 per cent of a development

Under the new budget rules, developers will no longer be able to sell every property in their new development to overseas buyers.

Instead, a maximum of half the development can be sold to foreign buyers with the rest to be sold locally. The budget documents note this is to provide a “clear message” that new housing stock is expected to increase supply for Australian buyers.

Before this change developers required pre-approval to sell properties to foreign buyers but there was no limit on the proportion of sales.

Effect on revenue: No impact

In place from: May 9, 2017

2) First Home Super Saver Scheme

First-home buyers weren’t ignored by the budget with a new First Home Super Saver Scheme announced. The new super saver scheme will allow first-time buyers to put up to $15,000 a year, to a maximum of $30,000 under the scheme, into their superannuation.

These funds can later be withdrawn for a home deposit, including any earnings the deposits made.

This means they will have a tax incentive to save more, and it can be taken advantage of as a couple with each claiming $30,000.

Effect on revenue: Cost of $250 million ($9.4 million funding given to ATO)

In place from: July 1, 2017 (contributions), July 1, 2018 (withdrawals)

3) An ’empty home’ tax on foreign investors

Foreign investors who keep properties vacant for more than six months will be faced with a vacancy tax. This is described as a charge on “underutilised residential property”.

The cost of this tax will be the equivalent of their foreign investment application fee – some several thousand dollars – and will be charged annually.

This change is intended to get more vacant homes onto the rental market.

Effect on revenue: Gain of $16.3 million ($3.7 million funding given to ATO)

In place from: May 9, 2017

4) Stopping investors from claiming travel deductions

Investors who previously had tax deductions for travel expenses related to their investment property will no longer be able to make these claims.

The government has ruled them out, even for those travelling to collect rent, maintain or inspect a premises, saying many have been incorrectly obtaining this deduction. This has included situations for “private travel purposes”.

Effect on revenue: Gain of $540 million

In place from: July 1, 2017

5) Retirees given incentives to downsize

Australians aged over 65 who sell their home of a decade or more will soon be able to put up to $300,000 in sale proceeds into their superannuation.

This incentive to downsize is expected to help free up larger homes for families to move into.

Effect on revenue: Cost of $30 million

In place from: July 1, 2018

Comments (0)

14 June 2017

By portermathewsblog

via reiwa.com.au

A new rental affordability study has highlighted the challenges very low and low income households face in Perth’s private rental sector.

A new rental affordability study has highlighted the challenges very low and low income households face in Perth’s private rental sector.

The study, Housing Affordability (Rental) – A study for the Perth metropolitan area, looks at rental affordability for households on very low (less than $43,000), low ($43,000-$69,000) and moderate incomes ($69,000-$103,000), and is the result of a second collaboration between the Housing Authority, Real Estate Institute of Western Australia (REIWA) and Shelter WA.

The report found:

- There is insufficient affordable rental options in Perth’s private rental sector, which is placing pressure on the region’s social housing system.

- 35 per cent of Perth rental households fall into the lower income categories, however only 19 per cent of rentals in Perth in the 2015-16 financial year were affordable to very low or low income earners.

- Perth’s rental stock lacks diversity, with over 70 per cent of all rentals across the metropolitan area have three bedrooms or more.

- The central sub-region contains the bulk of affordable rental housing in Perth. It provides 65 per cent of affordable housing for very low income earners and 49 per cent for low income earners.

REIWA President Hayden Groves said all sectors of the property market need to work together to increase the number of affordable rental properties.

The Housing Authority’s General Manager Strategy and Policy Tania Loosley-Smith noted that although the Western Australian property market has been in a cyclical downswing for the past few years, there is still a significant shortage of housing that is affordable for Western Australians on low incomes.

“By a range of measures, this shortage has entrenched over decades and deepened in the last 10 years. It affects our vulnerable citizens, as well as the key workers who are the backbone of our economy,” Ms Loosley-Smith said.

“The Housing Authority is committed to addressing these challenges in order to ensure Western Australian families, our local communities, and our economy thrive. That said, achieving these outcomes needs both Commonwealth and State leadership.”

Ms Loosley-Smith said she welcomed the Commonwealth Government’s commitment to establish a National Housing Finance and Investment Corporation, and its focus on models to increase affordable rentals for people on low incomes.

“Large scale market investment in our rental sector, particularly at the affordable end of the market, is the missing part of the Australian housing continuum and can only be tackled effectively at a national level. This, combined with ongoing funding for the social housing system under the National Affordable Housing Agreement and ongoing State efforts on housing supply and diversity is critical to ensuring that all Western Australians have a place to call home,” Ms Loosley-Smith said.

At the state level, the Housing Authority in late 2016 launched the Assisted Rental Pathways Pilot. According to Ms Loosley-Smith, this innovative initiative provides opportunities for social housing applicants—with the desire and means—to move successfully into the private rental market.

“This Pilot is a unique partnership between the government, not-for-profit support providers and participants. It offers rent subsidies and individually tailored support services for up to four years to help people succeed in the private rental market. The project offers benefits for both participants and landlords, and is important in addressing the key finding of the study—the lack of affordable rentals in Perth, despite a high overall rental vacancy rate.”

Mr Groves said housing affordability was a critical issue for West Australians and the report emphasised the glaring need for a greater emphasis on the provision for affordable, accessible and appropriate housing options.

“It is clear that the current stock of private rental accommodation does not meet the needs of our community and more needs to be done to address the requirement for choice and housing diversity. The planning system needs to mandate and address housing diversity within the WA planning system,” Mr Groves said.

Shelter WA spokesperson Stephen Hall said the research highlighted the lack of accessible and affordable private rental accommodation in Perth for very low and low income households, with only a small number of three or more bedroom properties available to these income brackets.

“This research shows that only a small number of three or more bedroom properties are affordable for lower income families. Shelter WA is concerned that families, especially large families, could be forced to reside in inappropriate and unaffordable housing.”

“It is also concerning that households, on very low incomes, including those on disability and aged pensions, are confronted with so few rental options in the Perth metro area. Seniors and those living with a disability, often already have difficulties in their lives, which can be exacerbated by unaffordable and insecure housing.”

“Improving inefficiencies in the planning system, replacing stamp duty with a progressive land tax, and ensuring social and affordable housing is provided in and around new developments such as Metronet, can improve the availability of affordable accommodation for Perth households,” Mr Hall said.

The Housing Affordability (Rental) – A study for the Perth metropolitan area is a follow up to a study released last November which focused on the impact of housing affordability on home ownership.

Comments (0)

14 June 2017

By portermathewsblog

Jane Eyles-Bennett via domain.com.au

You’ve made the decision to sell your home, but do you leave it as is or give it some renovation love? I work with clients every week who battle this question.

They are often worried that dollars spent could be dollars down the toilet. Where exactly is the happy balance between adding value and appeal to your home in order to attract buyers and the best price, and spending money unnecessarily?

The answer, unfortunately, is different for every property. However, after having helped hundreds of home sellers prepare their properties for sale, I have learnt a number of things. Here is a list of the most common mistakes I’ve seen:

You’ve made the decision to sell, but do you leave your home as it is or do some renovation? Photo: Simon Potter

You’ve made the decision to sell, but do you leave your home as it is or do some renovation? Photo: Simon Potter

Renovating the bathroom

This is a controversial one. I wrote an article recently called Renovating to Sell; You’re doing it wrong. In it I claim that the most important areas to get right when you’re preparing your home to sell are, in order, the exterior, kitchen, living spaces and then the bathroom.

The bathroom should get a little bit of loving, but do not splurge on this area if the exterior and kitchen aren’t in good shape. Sometimes a bathroom does need a major overhaul, but in many cases they’re no worse than the exterior and kitchen, which can be deal breakers for potential buyers.

If you need proof that a bathroom doesn’t necessarily need an overhaul, check out my client’s renovation, where he did almost nothing to it and still made $343,000 when he sold.

Totally transform the interior

Aside from costing an arm and a leg to completely gut and renovate the interior of your home (and risk not getting your money back, come time to sell), completely changing the design of an interior can be a dangerous move to make, especially if it doesn’t tie in with the style of your home.

Be it a Federation style, a Queenslander, an 80s brick house or something else, there’s nothing worse than a home with a super slick modern interior and no link to its original style. Creating a modern version of your home is the best way to go. Update old elements with new ones, in a way that complements and blends the original period with the current one.

The before shot of one of Jane Eyles-Bennett’s projects.

The before shot of one of Jane Eyles-Bennett’s projects.

Paint feature walls

In my opinion, feature walls are an absolute no go when selling a property. If you have them, my advice is always to get rid of them.

These days, the trend is to add impact with furniture, rugs, artwork and cushions. Decorating in this way will give the perception of a larger space. This is because the focal point is in the centre of the room. The more a feature wall or ceiling is focused on, the smaller a room can appear.

Render a brick exterior

I’ve seen so many homes unnecessarily rendered prior to selling. This is such a waste of money. Many assume that they will add value to their home automatically by rendering it but this is not always the case. An earlier article I wrote for Domain explains this in more detail.

Suffice to say, if you own a brick house, you usually don’t always need to render it to make it look great. Simple tricks with trim colours, new focal points and landscaping can work absolute wonders.

The after shot of one of Jane Eyles-Bennett’s projects.

The after shot of one of Jane Eyles-Bennett’s projects.

Don’t forget to clean and tidy your home

While you do need to clean and tidy your home, it’s essential that you also declutter. This includes getting rid of any items that make the home specific to you. Things like family photos, Nana’s crochet blanket, kids artwork and trinkets – all need to go.

Pare back your space, but leave enough visual interest so the house isn’t boring. The intention is to create a blank canvas for buyers to imagine themselves living there. Be sure to leave enough room for their imagination to fill in the gaps.

Jane Eyles-Bennett is one of Australia’s leading home renovation and interior design experts. She is an award-winning interior designer with more than 25 years’ experience designing the interiors and exteriors of homes; specialising in kitchens, bathrooms and living spaces.

For more information about what might suit for your own property gives us call on 9475 9622 or email us at mail@pmmetro.com.au

Comments (0)

14 June 2017

By portermathewsblog

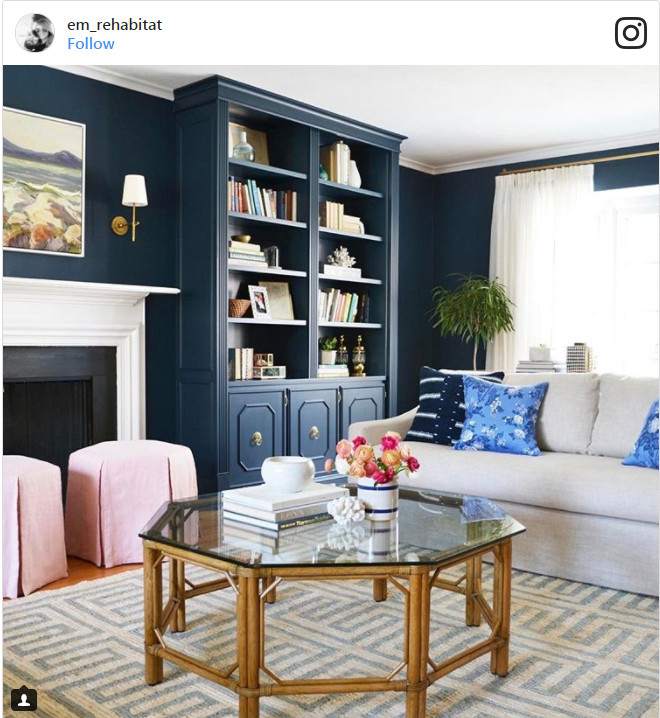

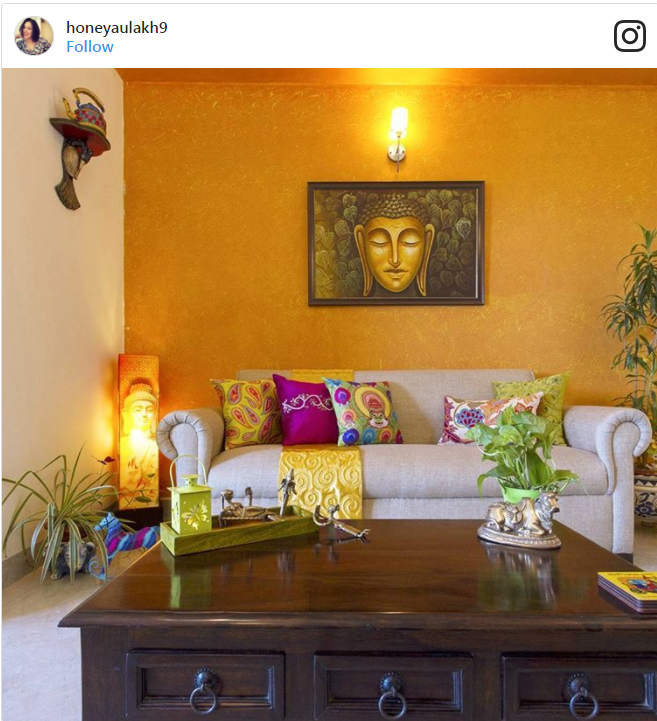

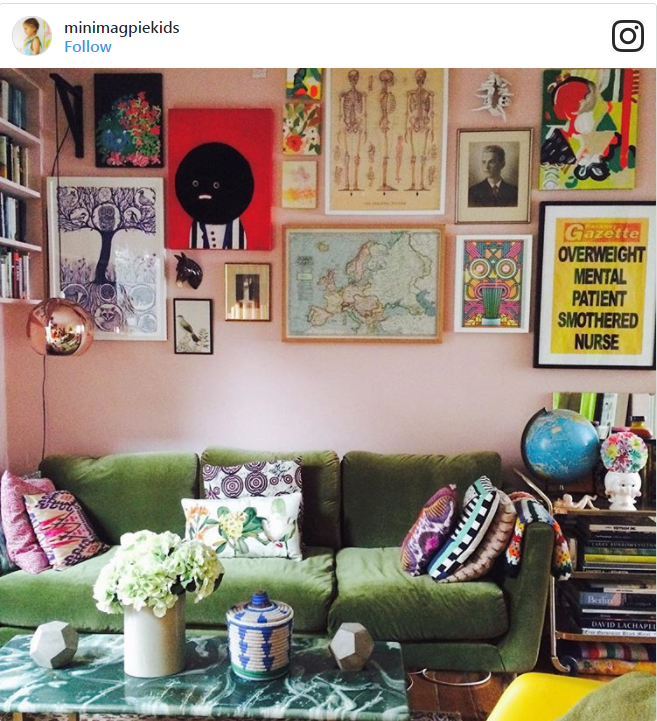

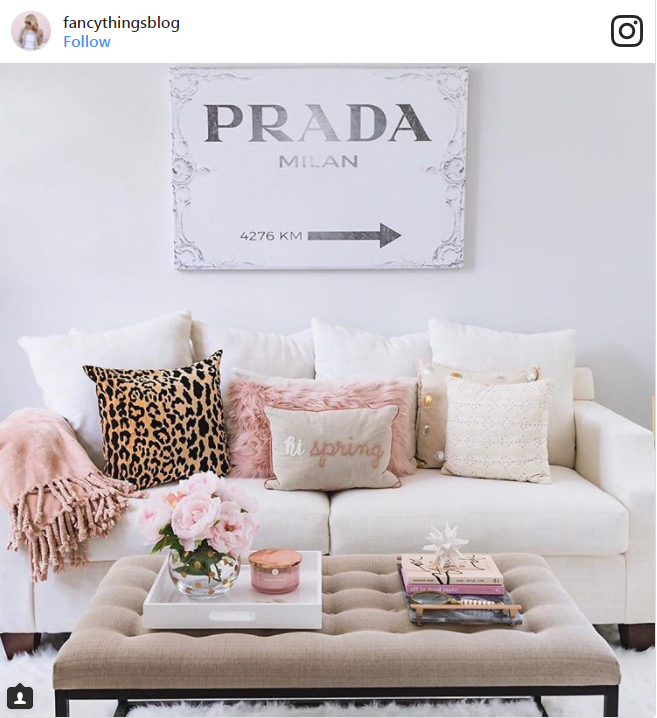

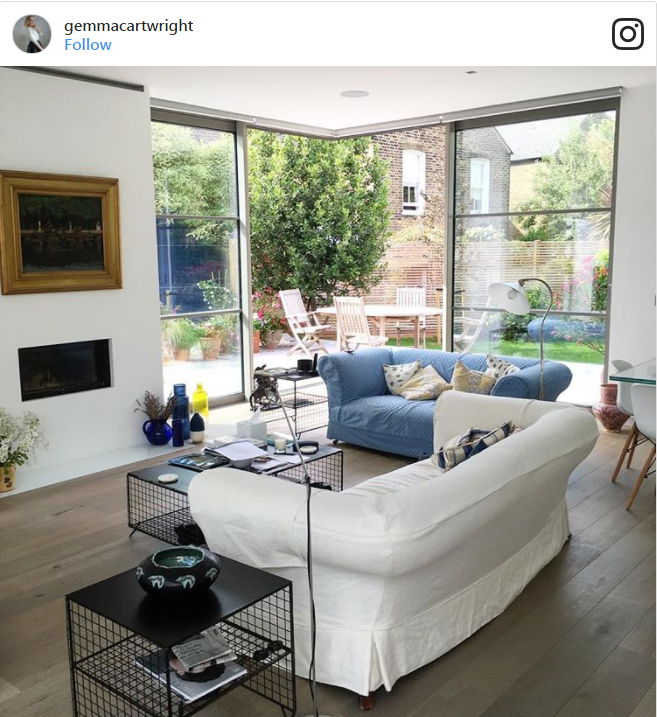

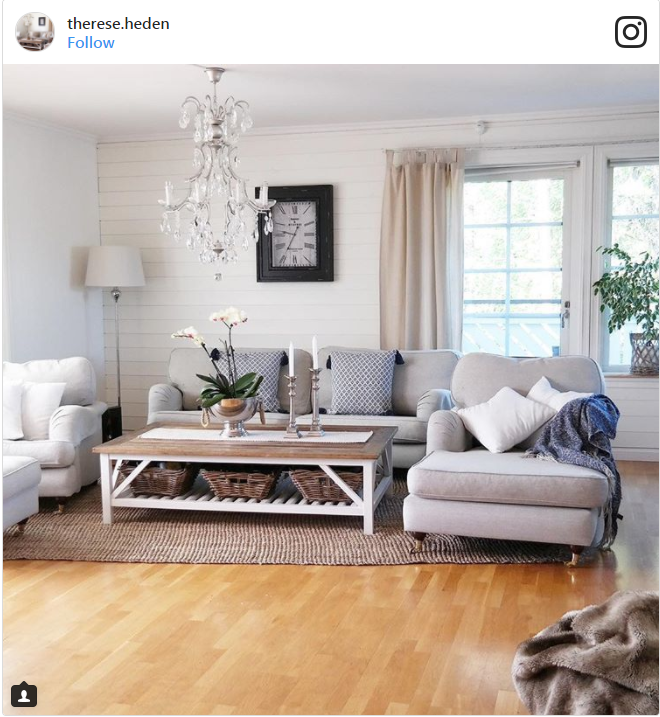

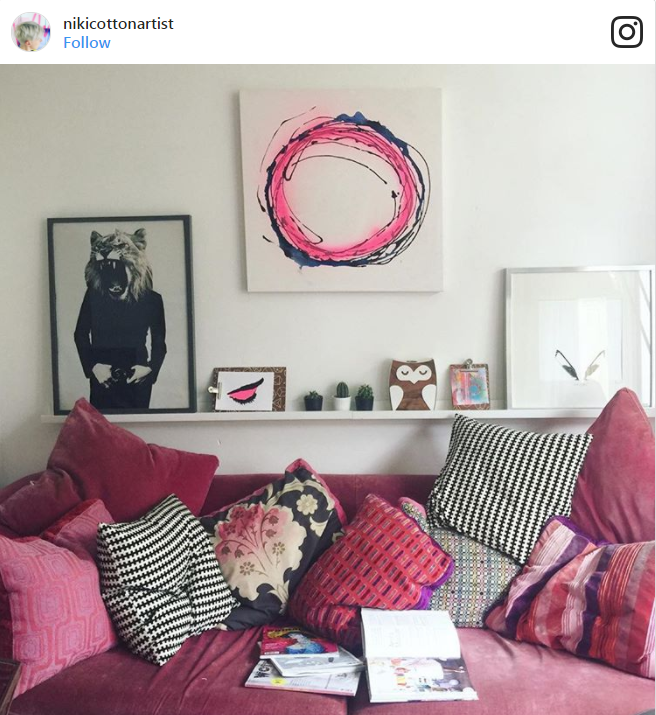

You’ve got your bedroom looking cosy and the kitchen has been overhauled. Now it’s time to turn your attention to the living room. Luckily, the lounge is one of the easiest rooms in the house to redecorate: a lick of paint, a new sofa (or cover) and some cleverly chosen ornaments, throws, and cushions are often all you need. The following rooms cover all styles, from minimal Scandinavian-inspired design to upcycled boho, and will inspire your next living room revamp. It’s time to start hoarding paint samples!

1 Palm Tree Accents

2 Pastel and Wicker

3 Moody Blue

4 Teal Touches

5 Cherry Pop

6 Cosy and Chic

7 Colourful Eclectic

8 Dark and Dramatic

9 Grey Days

10 Bold Gold

11 Cobalt and Lilac

12 White and Gold Marble

13 Midcentury Music Fans

14 Salvaged Chic

15 Pastel Pink Perfection

16 Upscale Pastels

17 Classic Linen

18 Retro Revival

19 Colourful Crafts

20 Ladder Shelves and Houseplants

21 Statement Furniture

22 Fashionista Greys

23 Pink, White, and Cosy

24 ’60s Orange

25 Blue-Grey and Bold

26 Pastel Sofa and Statement Rug

27 Shades of Beige and Brown

28 Let the Light In

29 Retro Woods and Pops of Colour

30 Greyscale Chic

31 Cosy Cream

32 Pops of Pink

33 Textured Layers

34 Bringing the Outside In

35 Bowie and Velvet

36 Grey and Copper (and Cats!)

Comments (0)

14 June 2017

By portermathewsblog

via reiwa.com.au

Housing affordability and rental affordability improved in Western Australia in the March quarter 2017, according to the findings of the latest Adelaide Bank/REIA Housing Affordability Report.

Housing affordability and rental affordability improved in Western Australia in the March quarter 2017, according to the findings of the latest Adelaide Bank/REIA Housing Affordability Report.

Housing market

The report found affordability in WA’s housing market improved over the quarter, with the proportion of income required to meet loan repayments decreasing 0.9 percentage points to 23.4 per cent.

Affordability also improved over the year, with figures showing the proportion of income required to meet loan repayments in the March quarter 2017 declined by 1.1 percentage points compared to the March quarter 2016.

Rental market

WA’s rental market was more affordable in the March quarter than it was in the December quarter, with data revealing the proportion of family income required to meet the median rent price decreased by 0.5 percentage points to 18.6 per cent.

Compared to the same time in 2016, the proportion of income required to meet the median rent decreased by 1.6 per cent.

First home buyers

The volume of first home owners in the market decreased by 6.5 per cent in the March quarter to 3,562, and by 1.8 per cent when compared to the March quarter 2016.

The report found that of all first home buyers in Australia, 17.2 per cent were from WA. Additionally, that proportion of first home buyers in WA equated to a significant 31.5 per cent of the state’s owner-occupier market.

The average amount WA first home buyers spent on their loans in the March quarter decreased by 4.1 per cent to $307,800. Affordability in this sector improved further when compared to the same time last year, by 4.9 per cent.

Loans

There were 11,301 loans (excluding refinancing) taken out in the March quarter, which is a dip of 6.4 per cent on the December quarter 2016 and 3.2 per cent on the March quarter 2016.

The average loan size amount also decreased in the March quarter, by 3.8 per cent to $337,812. Compared to the same time last year, this figure is down 0.6 per cent.

For more information about the market give us a call on 9475 9622 or email us at mail@pmmetro.com.au

Comments (0)

14 June 2017

By portermathewsblog

Ugly window treatments are the thorn in almost every renter’s rear. Plastic mini blinds — or worse, vertical blinds — are automatic aesthetic killers, but they can be remedied for a shockingly small amount of money. The key to making dirt-cheap window treatments look like a million dollars is as easy as knowing where to shop and mastering the designer tricks for hanging them properly. This foolproof formula will instantly elevate the look of any room — we promise!

Start With the Classics: White Linen Curtains + Black Curtain Rods

You cannot go wrong with white linen curtains and black rods with simple finials. Think of it as the tuxedo for interiors, only a tux that plays well with any style, from formal traditional to California casual. This pared-down colour palette also grants you permission to go bananas with colours and prints in other places in the room and you won’t get sick of your choice halfway through your lease.

Find Affordable Versions of the Classics

Absurdly cheap price point aside, these Ikea Lenda curtains ($29.99 for a pair) are actually beautiful in person and well-loved by design bloggers. You can add Ikea’s black-out liner to create a thicker, heavier drape, which can make them look even more formal, or leave them as is if you want them to filter (not block) light while adding privacy. They also come with heading tape along the top back of the curtains, which makes it easy to create pleats with hooks and curtain rings.

Use Curtain Rings:

Using curtain rings makes opening and closing curtains a cinch, but designers also prefer their polished aesthetic. Adding rings creates neatly pinched pleats that keep curtains looking beautiful, open or closed.

Know How to Hang Your Curtains:

Create the optical illusion of sky-high ceilings by hanging your curtains as close to the ceiling as possible. You’ll be amazed by how drastically this shifts the look and feel of a room.

- Extend drapery rods out about four to six inches (not including the finial). This will make your window appear wider and allow you to enjoy the full spans of your window when the curtains are open.

- Hang curtains so that the bottoms barely touch the the floor or have one or two inches of fabric on the floor. If your curtains are longer, you can have them hemmed by measuring and pinning them to the desired length once you’ve hung them. If they aren’t long enough, you can add more fabric for a cool colourblock look, no sewing needed!

Image Source: Studio McGee

Comments (0)

14 June 2017

By portermathewsblog

Winter’s chill brings cosy decor and lazy afternoons spent sipping hot chocolate in front of the heater, but it can also bring major electrical bills. If heating your home is seriously expensive, then you’re going to want to read these 12 cost-effective ways to stay warm this Winter.

-

- Get the Right Window Coverings

If you’ve ever stood next to a drafty window, then you can attest that they’re major culprits of heat loss. Investing in thick, lined curtains or adding liners to your existing curtains (Ikea have them for $29.99 a pair) will keep the cold air out. Keeping them closed during Winter you can cut your energy bill down by up to 20 percent.

Create an extra layer of padding between the elements and your house by adding a storm door. While it’s a little bit pricier up front, you can reduce energy loss up to 50 percent by purchasing a storm door made with low-emissivity glass or coating.

-

- Install a Programmable Thermostat

Instead of keeping your heat on full blast all day, use a programmable thermostat to set the temperature to turn it down while you’re out in the middle of the day and turn it back up right before you come home in the evening. Turning the temperature back at least 10 degrees for eight hours a day can save you up to 15 percent a year on your heating bill.

Invisible cracks and gaps around the house allow valuable heat to seep out. Taking a little time in Summer or Autumn to caulk or weather strip these leaks around the house will save you big money on your energy bill come Winter. Common areas in need of insulation include the space between the baseboard and the floorboard, behind electrical outlets, and around windows and attack hatches.

Ceiling fans usually have a switch you can flip to change the direction the fan blades are rotating in. By simply switching it to clockwise rotation in Winter, you’ll push hot air that has risen to the ceiling back down into the room. Doesn’t get easier than that.

It’s a lot cheaper to throw on a sweater and some fuzzy slippers than to crank up the heat every time you get chilly, so keep warm layers close at hand and the temperature at a reasonable setting.

-

- Improvise Wall Insulation

If tearing down the drywall to add insulation isn’t an option, then it’s time to get clever. You can line chilly external walls with cold-absorbing materials like a tall shelf filled with books, use decorative screens as cold air blockers, and even line baseboards with cardboard.

-

- Position Furniture Around Heat Sources

For a free and temporary fix, give your living spaces a Winter makeover by rearranging furniture away from cold external walls and around heat sources, like the fireplace. It will make those frigid nights more enjoyable.

As the nights get longer, our lights stay on for — longer but it doesn’t have to cost more. LED bulbs use 85 percent less energy compared to traditional globes and have a lifespan of 25,000 hours.

Wooden or tiled floors can be really cold under foot in Winter. Laying a thick rug that feels soft under-foot will help keep your home cosy.

Swapping your quilt for a thicker one or adding an extra blanket (between the sheet and quilt) will keep you warm at night without using a heater.

Getting your washing dry can be hazardous when the weather is bad, but making the most of any sunny moments will save you on dryer costs. Pick up a portable dryer that you can quickly bring in if the weather gets bad or keep inside by a window.

Comments (0)

14 June 2017

By portermathewsblog

via domain.com.au

The search is over – you’ve settled on your new address. The movers are booked, the boxes are packed, now what? It’s time to make that place feel like home. It’s easy to get carried away with all the big changes and costly renovations you’d like to make, but they are not always possible, at least not right away. In the meantime, here’s your six-step go-to guide to turning any space into a place you’ll love calling home.

1. Clean and scrub

Okay it might seem obvious, and an easy one to palm off to a professional, but even if you do spring for an expert to help with the heavy lifting, there’s much to be said for getting down and dirty yourself. It helps you bond with your home and get to know its structure and its unique quirks. You can’t beat a sense of intimacy with your space for making it feel like a home.

Photo: Pottery Barn

Photo: Pottery Barn

2. Respect those who came before you

Whether it’s the architect who designed your apartment or the decades of homeowners before you, take a moment to put yourself in their shoes. Can’t bear those old slate floors at first sight? Hang in there. Embrace your home’s idiosyncrasies, including the questionable style choices of past owners, and try not to be arrogant. Maybe the house has a point. Wait to see what it might be before diving into an expensive new fitout.

3. Make a floor plan for the way you actually live

This includes choosing furniture that will service the way you use your home. For instance, there’s no point taking up precious space with a large formal living room if you only ever eat at the kitchen bench. Maybe a few new barstools are all that’s required for an eat-in kitchen, leaving you a whole spare room to turn into a much-needed study. Alternatively, replacing your pair of bulky, two-seater sofas with a single sectional sofa might help de-formalise and open the layout of your new living area.

Photo: west elm

Photo: west elm

4. Run for covers

The easiest, most affordable reno-free makeover you can give any space is paint and textiles – in that order. If paint is a priority to freshen up a tired or grubby place, then you can’t go wrong with basic white (and it’s easy to go over later). Textile-wise, start with rugs and curtains, choosing designs that reflect your style and complement the period of your home. Finally, finish with cushion covers – you’d be amazed at the way they will transform any tired sofa or uninspired corner.

5. Allocate a place for everything you own and everything you use

A little planning at the start will help curb the clutter and keep your home tidy and more manageable over time. For example, if a vast book collection is your pride and joy, then a wall dedicated to open shelving may be a better use of space than a pretty sideboard and mirror. Or if you’re keen cyclists in a tiny apartment, a wall-mounted bike rack might be just the wall decor for you.

6. Tell your story

Displaying photos, personal collections and travel mementos are well worn ways of reflecting and celebrating the people who live in a home, but there are other subtle solutions, too. Introduce a favourite, memory-inducing fragrance via a vase of fresh flowers or a scented candle. Or add a glass cloche or display box with a favourite childhood object or holiday souvenir to instantly bring that personal touch home.

Photo: Pottery Barn

Photo: Pottery Barn

Comments (0)

07 June 2017

By portermathewsblog

There are fears the launch of a “rent bidding” app will push Aussie rents up even higher. Photo: Jim Rice

There are fears the launch of a “rent bidding” app will push Aussie rents up even higher. Photo: Jim Rice

Following a lengthy period of falling rents and sharply rising vacancy rates, early signs are now emerging that the Perth rental market may be steadying.

Latest Domain data reports that the median asking rent for a Perth house over April remained at $360 per week, the same as reported over the previous month. Although steady over the month, Perth house rents are 10.0 per cent lower than recorded over April 2016.

Median asking rents for units were also steady at $300 per week over the month but similar to house rents have fallen sharply over the past year – down by 14.3 per cent.

Similar to rents, Perth vacancy rates have also stabilised over April at 3.9 per cent for houses and for units down from 4.2 percent recorded over March to 4.1 per cent. Total vacancy rates for both houses and units combined fell to 3.9 per cent over the month which was the lowest result since March 2016.

Although rents and vacancy rates have steadied over the past month, Perth remains the most tenant-friendly mainland capital with relatively low rents and a wide choice of available homes. By contrast, vacancy rates in most other capitals are generally tight and tightening for both houses and units.

Sydney remains the most expensive capital for tenants with a median asking weekly rent over April of $550 for both units and houses. This is an increase of 3.8 per cent for each over the past year and 52.8 per cent higher than Perth for houses and remarkably 83.3 per cent higher for units.

For more information on property management contact Ron Padua on 0404 428 843 or email bdm@pmmetro.com.au

Comments (0)

06 June 2017

By portermathewsblog

Has your place been looking a little . . . clogged up lately? Well, it may be time to do a little cleaning up! However, if you’ve been following these rules below, you wouldn’t need a decluttering session as your home is guaranteed to be clutter-free.

1. Get rid of duplicates

If you have duplicates lying around, get rid of them if they are not necessary. Keep the better duplicate and trash or donate the other.

2. Get rid of things you haven’t used in a year

So you keep telling yourself that you’ll use it eventually, but if you haven’t touched it in a year, chances are that you’re not going to in the near future. Do your home a favour and get rid of the items that aren’t getting any use.

3. Digitise nostalgic items

Do you have too many nostalgic items that you can’t seem to get yourself to give away? Take photos of them and then get rid of them — you’ll be able to keep them around forever without cluttering up your space.

4. Don’t keep items out of guilt

I’m sure you have a thing or two around the house that you keep out of guilt. Perhaps it’s a sweater sweet Aunt Betty knitted for you for Christmas that you never wear or that fancy dress you splurged way too much on. Time to be brutal and get rid of them all.

5. Put things back where they belong

It’s easy to just leave things lying around, but that’s how clutter builds up. After you’re done using something, immediately put it back where it belongs so you won’t procrastinate.

6. And find a home for them

Make sure every item in your home has a place, whether it be a plastic container or an under-the-bed organiser. And remember: a pile of items is not a true place for your things.

7. Sell, give away, donate, upcycle, or throw away

When assessing things you want to get rid of, start by seeing if you can make some of your money back by selling it. Here are some avenues for selling different types of clutter.

If you don’t think it’s worth the effort to sell, give it away to people you know who will use it. Perhaps to your family and friends, or even your Facebook network. You can also choose to donate it to get a tax write off.

8. Don’t keep items you wouldn’t buy now

Are there some items you have that you would never buy now? Perhaps you should take a good hard look at them and figure out why you need them now and if you can do without them.

9. Opt for covered furniture

If you have a clutter problem, choose furniture that is covered, such as a closet with a sliding door instead of open shelves. This will help your place look cleaner and more organised.

10. Don’t forget storage under your bed

There’s a lot of real estate in your home that’s not being put to good use; one that people often forget about is under-the-bed storage.

11. Think tall

Use up all the space in your home to make the most of it, including the vertical space. The more space you have for your stuff, the less likely it’s going to get cluttered up.

12. Evaluate your spending

If you’re buying things you don’t need, take a hard look at your spending. Perhaps you need to take part in our 30-day spending hiatus to motivate yourself.

Image Source: POPSUGAR Photography

Comments (0)