15 October 2018

By portermathewsblog

via reiwa.com.au

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

Affordability in Perth’s residential sales market improved during the September 2018 quarter, with house and unit prices softening marginally.

REIWA President Damian Collins said there was excellent opportunity for buyers and investors to take advantage of current market conditions to secure their next home or investment property.

“While the worst of the market downturn appears to be behind us, the results of the September 2018 quarter reveal conditions are favourable for buyers and investors,” Mr Collins said.

Median house and unit price

reiwa.com data shows Perth’s median house price should settle at $505,000 for the September 2018 quarter.

“This is 1.9 per cent lower than the June 2018 quarter median and one per cent lower than last year’s September quarter,” Mr Collins said.

“While quarterly median figures can be more subject to stock composition changes, the fact that the annual change is only one per cent lower suggests that we are at or near the bottom.

“It was a similar story for the unit market, with the median expected to settle at $395,000, which is 1.3 per cent lower than the June 2018 quarter and 2.5 per cent lower than the September 2017 quarter.”

While the overall market experienced a decline in median house price during the quarter, 57 suburbs across the area bucked this trend.

“The top performing suburbs for median house price growth were Swan View, East Cannington, Como, Hillarys and Cottesloe.” Mr Collins said.

“In the unit market, Maylands, Midland, Tuart Hill, Fremantle and Claremont were the suburbs with the strongest price growth.”

Sales activity

There were fewer sales in the September 2018 quarter than there were during the June 2018 quarter.

Mr Collins said reiwa.com data showed 6,428 sales for the quarter, which was 4.9 per cent lower than last quarter.

“It’s not uncommon to experience a decline in sales during the September quarter, with West Australians typically less inclined to search for property during winter. We tend to see activity slow during the winter months before increasing again as the weather warms up,” Mr Collins said.

The share of house sales in Perth has increased, with reiwa.com data showing houses now comprise 74 per cent of all sales, compared to 65 per cent at the same time last year.

Perth’s top selling suburbs for house sales during the September 2018 quarter were Baldivis, Canning Vale, Morley, Dianella and Gosnells, while the suburbs to record the biggest improvement in house sales activity were Cooloongup, The Vines, Alexander Heights, Mirrabooka and Wattle Grove.

“It’s a good time to buy, which is reflected in the fact a higher proportion of houses are now being sold. This shift in the composition of sales (houses, units and land) indicates buyers are more inclined to purchase a house than they might have otherwise been. This can be attributed to housing affordability improving across the metro area, which has made buying a house a more attainable property purchase,” Mr Collins said.

“We’ve also seen an increase in activity between the $350,000 and $500,000 price range during the September quarter, which is pleasing as it indicates first home buyers remain an active component of the Perth market.”

Listings for sale

There were 13,850 properties for sale in Perth at the end of the September 2018 quarter.

Mr Collins said stock levels across the metro area had declined 3.7 per cent during the quarter.

“It’s pleasing that, although there were fewer sales this quarter, listing stock continues to be absorbed.

“This is the third consecutive quarter we’ve seen listings for sale decline, which is a positive step forward in the market’s recovery,” Mr Collins said.

Comments (0)

23 July 2018

By portermathewsblog

via therealestateconversation.com.au

Real estate in Perth is at its most affordable on record, as falling prices give first home buyers their best chance of stepping onto the property ladder, according to the Housing Industry Association (HIA).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List. Abel McGrath

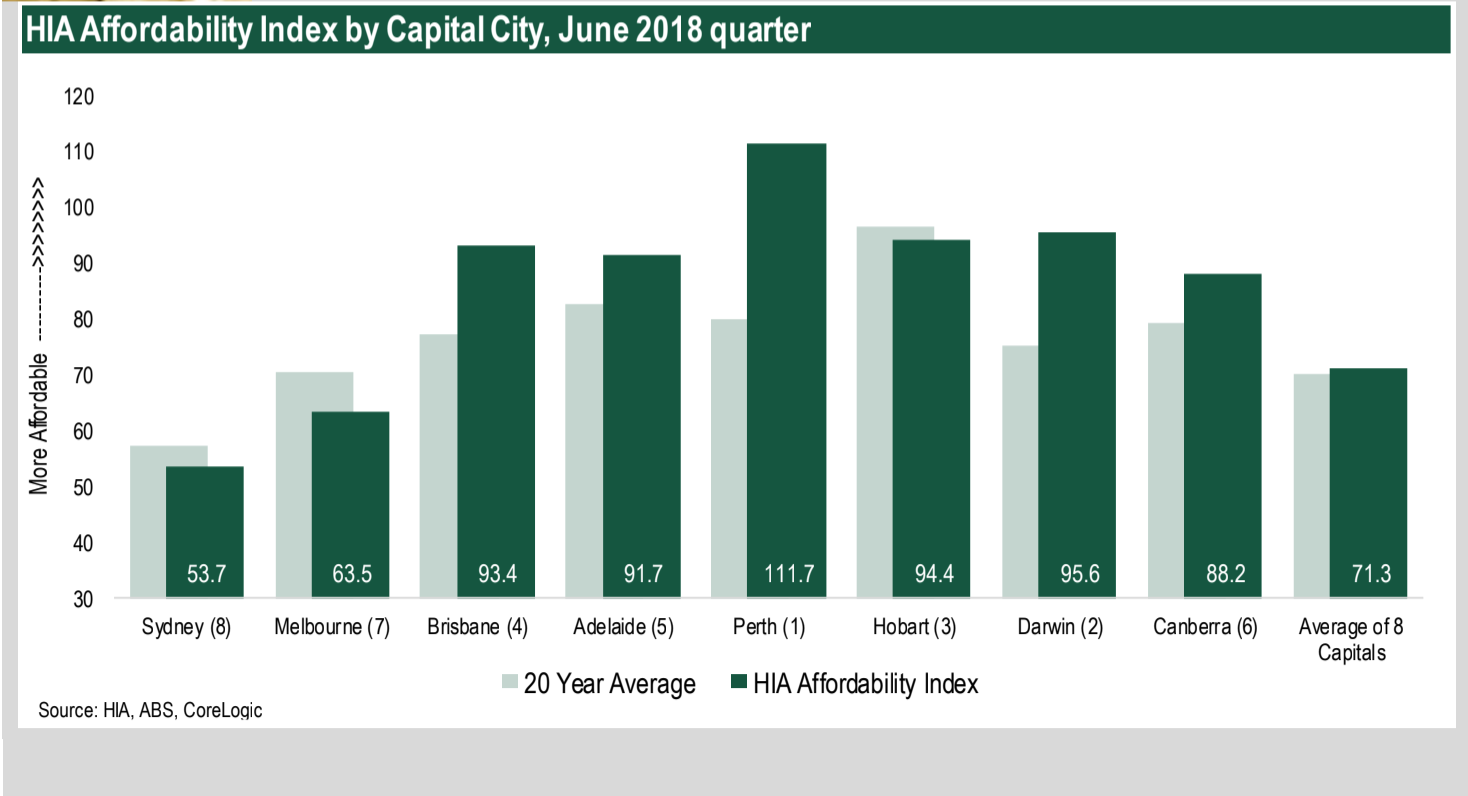

Figures from the Housing Industry of Australia (HIA) Affordability Index show Perth is the most affordable of the nation’s capital cities.

In the June 2018 quarter, the Housing Industry of Australia (HIA) Affordability Index registered 74.9, up by 0.4 per cent over the quarter and up by 0.8 per cent compared with a year earlier when affordability had reached its poorest level in nearly six years.

The HIA Affordability Index is designed so that a result of exactly 100 means that precisely 30 per cent of earnings are absorbed by mortgage repayments.

Higher results signify more favourable affordability – those above 100 signify that mortgage repayments account for less than 30 per cent of gross earnings, whereas scores below the 100 mark mean that more than 30 per cent of average earnings are absorbed by mortgage repayments.

According to HIA’s analysis, Perth is the most affordable capital city to buy a home in with an affordability rating of 111.7, closely followed by Darwin (95.6), Brisbane (93.4), and Hobart (94.4).

37 Marita Road, Nedlands, Perth under offer with Michelle Kerr from Abel McGrath as featured on Luxury List.

“Perth continues to present good opportunities for buyers, especially in the more affordable end of the market,” President of the Real Estate Institute of Western Australia (REIWA) Hayden Groves told WILLIAMS MEDIA.

In news that will surprise approximately no one, Sydney remains the least affordable capital city to purchase in, with a miserable affordability rating of 53.7.

Key findings from the HIA Affordability Report

- Easing price pressures are driving the improvements in housing affordability

- Housing affordability improved in five of Australia’s eight capital cities for the June 2018 quarter – Hobart, Melbourne and Adelaide were the only capital cities to see a deterioration

- Perth is now Australia’s most affordable capital city, followed closely by Darwin and Hobart

- Mortgage repayments account for 42.1 per cent of earnings in capital cities and 34.3 per cent in regional markets

HIA Economist Diwa Hopkins says affordability is hugely improving considering this time last year, affordability was at the lowest level in over six years.

“Easing house price pressures are providing some affordability relief for home buyers.

“Previous strong price increases were met by an unprecedented level of building which is now starting to come online. This is providing much-needed additional supply in key markets, helping to reduce price pressures and ultimately improve affordability for home buyers,” Hopkins said.

Source: HIA

Source: HIA

But the current plunge in house prices is unlikely to last for long, Hopkins warns.

“With an even balance in overall housing supply and demand in these key markets, the current downturn in dwelling prices is unlikely to be prolonged or severe.

“We could expect this downturn in prices to play out like previous cycles. They typically last 12 to 18 months, with the size of the fall modest relative to the immediately preceding expansion,” Hopkins said.

Ongoing fallout from the resources boom and bust cycles to thank for price plunge

Both rent and dwelling prices have been falling in Perth and Darwn for the last five years, amid the ongoing fallout from the resources boom and bust cycles.

While this is great news for renters and buyers in a market previously notorious for poor housing affordability, Hopkins warns it may be symptomatic of wider economic problems and in particular slowing population growth.

The weak economic conditions in both of these cities are seeing more people leave for interstate than are arriving, Hopkins says.

In particular population growth has followed these cycles and currently both cities are seeing more people leave for interstate than are arriving, resulting in spare capacity in their respective housing markets.

New home building activity has also fallen sharply in both cities as a result of the price declines, which risks causing an undersupply to emerge over the longer term in Perth and Darwin.

Groves told WILLIAMS MEDIA buyers are cautious right now.

“Trade-up family home buyers are lamenting they didn’t buy six months ago when the bottom of the market was apparent. Sellers who’ve been considering selling over the past few years are now cautious about coming to market too soon in anticipation of selling for more in the short-term future, especially down-sizers looking to maximise their capital-gains-tax-free benefit.

“Investors are likely to remain cautious until they see tangible growth which is likely to be towards the end of this year,” Groves said.

The best suburbs in Perth to invest in

According to data from REIWA, the rental yield for the Perth Metro region for houses currently sits at 3.6 per cent based on the overall median house rent price of $359 per week and median house price of $512,500.

This means on average, a typical property investor can expect to generate a 3.6 per cent annual return on their house purchase price.

REIWA says the suburbs of Bullsbrook, Medina, Parmelia, Armadale, Cooloongup, Maddington, Stratton, Camillo, Warnbro and Merriwa are house rental hotspots, offering investors the best return on their investment.

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

9 Bates Way, Warnbro available for rent through Property Osborne Park, as featured on Thehomepage.com.au

“Whilst the Perth property market is showing signs of a recovery in 2018, buyers and tenants remain the beneficiaries of the current environment, with a good supply of housing and rental stock to choose from at the more affordable end of the property market,” he said.

“With our local market on the cusp of recovering, now is the time for buyers and investors to take advantage of favourable conditions before our local market becomes less affordable,” Groves told WILLIAMS MEDIA.

Chief Operations Officer for Professionals Real Estate Group in Western Australia, Shane Kempton agrees.

“In the vast majority of areas in Perth, property prices are very low and buyers should now move quickly to secure a property before the recovery in the market gains further momentum to avoid buyers regret,” Kempton told WILLIAMS MEDIA.

View the Housing Industry of Australia (HIA) Affordability Index here.

Comments (0)

18 June 2018

By portermathewsblog

via therealestateconversation.com.au

Buying and selling property in WA has traditionally been by way of a conventional private treaty arrangement, however buyers and sellers are missing out on a more pure form of transaction, and that’s the auction.

Granted, auctions are becoming a more accepted selling method and the numbers of weekly auctions in WA has increased significantly over the past five years, but still lag a long way behind private treaty sales and the Eastern states. So why is that we’ve been slow to jump on the auction bandwagon?

Firstly, WA’s law for property transactions using the current “Offer & Acceptance” method protect both buyer and seller and in the majority of cases are easy to follow. The system works effectively for all parties to the transaction including the buyer, seller, settlement agent/conveyancer and banks. The downside of this system is that is can be time consuming and in many cases is conditional upon buyers obtaining finance, property inspections, having to sell their current home, etc.

More importantly, the system has a major flaw in it and that’s the asking price is disclosed and typically buyers knock the price down to where they feel comfortable – so it’s not good for sellers.

So why should we look to auctions? The auction system is the most pure form of selling and buying as there are no “secrets” surrounding price or selling terms; all terms are provided in the marketing campaign and the buyers set the price on where they see value. Selling by auction in most cases is quicker than private treaty. And the seller has three bites of the cherry; sell before auction day, on auction day or usually within 30 post auction day.

There are two main misconceptions surrounding auctions:

1. They cost too much. The cost of the auction is merely the auctioneer’s fee for calling the auction and working with the seller, buyer and agent to achieve the desired result. Typically, an auctioneers’ fee is in the vicinity of $700 to $1000. All other costs are associated with the marketing campaign to promote the property.

2. Auctions only “work in expensive areas”. That’s just a suburban myth. There’s many examples of properties below the current Perth median price of $510,000 selling at auction.

WA is one of only two states, the other being Tasmania, that don’t have a cooling off period in our property contracts. A cooling off period allows the buyer to “break” the Offer to Purchase usually between 2 to 5 business days after the offer has been signed. In other words, if the buyer changes their mind for whatever reason they can legally break the offer and walk away for a very small consideration to the seller, usually between 0.2% – 0.25% of the purchase price.

As WA doesn’t have cooling off provisions in our property contracts, this makes it far too easy for sellers and agents to default to Private Treaty transactions. If cooling off provisions were introduced to our property contracts, I’d predict a huge increase in the number of property auctions taking place in WA.

Finally, too few real estate agents embrace auctions and the auction process with vigor. They lack confidence and in some cases, the ability to explain the different marketing options available to sellers and automatically default to Private Treaty. This is a marketing injustice to sellers and the sooner we can demystify and legitimise the auction process for both buyers and sellers, the better.

Comments (0)

27 November 2017

By portermathewsblog

Adrian Ballantyne via realestate.com.au

With the real estate market continuing to roll from strength to strength, trying to determine a property’s true value is an ever-present challenge for buyers.

Snaring the property you want while avoiding paying too much is the dream, but how do you make that happen? As a buyer, how do you ensure you purchase at the right price every time?

Some of Melbourne’s leading buyer’s agents share their tips.

Buyers need to know what a property is really worth. Picture: Getty

Buyers need to know what a property is really worth. Picture: Getty

Know your goals

The “right” price for a particular property won’t be the same for everyone.

For example, a first-home buyer might see a certain price as fair for a property, while an older couple looking at downsizing might be perfectly comfortable paying $100,000 more to ensure they get hold of it.

Kristen Hatt, from buyer’s advocates Woledge Hatt, says being crystal clear about what you want from a property will help determine what your right price is.

“It’s about having a really good understanding of what you’re trying to achieve, and then making sure that property will meet all of those goals, because then you can make decisions around price as well,” she says.

“Understanding what the property is and the likelihood of (a similar property becoming available again), will determine the right price for you.”

How to negotiate a property price:

Research, research, research

When it comes to determining the right price for a property, there’s no substitute for market knowledge and conducting your own research.

Luke Assigal, from Parley Property Advisory, says it’s important to frame your own market, rather than blindly following the selling agents and their indicative price ranges.

“That includes taking the statement of information with a grain of salt as well,” Assigal says.

“The statement of information gives you a bit of an idea, but there’s been a lot of examples where the indicative selling range is out by 10% to 20%.”

“Look at the location, look at the council area. What is it close to? Is it close to commission housing; is it close to industrial; is it on a main road; what age is the property; has it been renovated in the last five years; what is the aspect of the property; what is the floor plan like? All of these little characteristics add up to what the property’s worth. At the end of the day it’s like a science.”

Get a property value estimate as part of your market research.

Inspect in person

All property knowledge isn’t necessarily equal. While looking at properties and results online will give you some measure of knowledge, there’s no substitute for checking out properties in the flesh, Hatt says.

“Just getting the results of properties doesn’t necessarily tell you about the properties,” she says.

“Sometimes a property sells for a certain price because it has a major structural issue, and you can say: ‘Well that’s why it was cheap’. Understanding more about each property is important.”

Home tips for buyers:

Calculate based on square metres

Some agents are reporting that for many properties, calculating the likely sale price based on the rate per sqm of land is proving increasingly accurate.

Again, it’s about research. If a number of properties nearby have sold for around $5000 per sqm often you can expect a very similar rate for the house you’re eyeing off.

“You can do square meterage, particularly when you’re dealing with larger blocks and development blocks in blue chip areas,” Assigal says.

“You can get access to stats quite easily – most properties have the square meterage listed online.”

It doesn’t necessarily mean the property will be the right price for you, but at least you’ll know how much you’re likely to be up for if you decide to bid.

Use a buyer’s advocate

Studying the market yourself each week is one thing, but consider for a moment that there are people who do it professionally.

While the average punter researches properties only when they’re actively looking to buy one, buyer’s advocates/agents have knowledge and expertise built up over many years, and can give an almost instant appraisal of what a property should be worth.

Hatt says that with buyer’s advocates, you’re paying for that superior market knowledge, as well as their ability to sniff out properties based on your personal requirements and circumstances.

“We were chatting to clients the other day and talking about a specific bayside area, and I said that over the last five to 10 years I would have been through 80% of the homes in that area that have been for sale over $1 million,” she says.

“That’s knowledge that you can’t just get by going to a few open for inspections and thinking that you’ve got an understanding. A lot of buyers are only in and out of the market in a very short period of time.”

Comments (0)